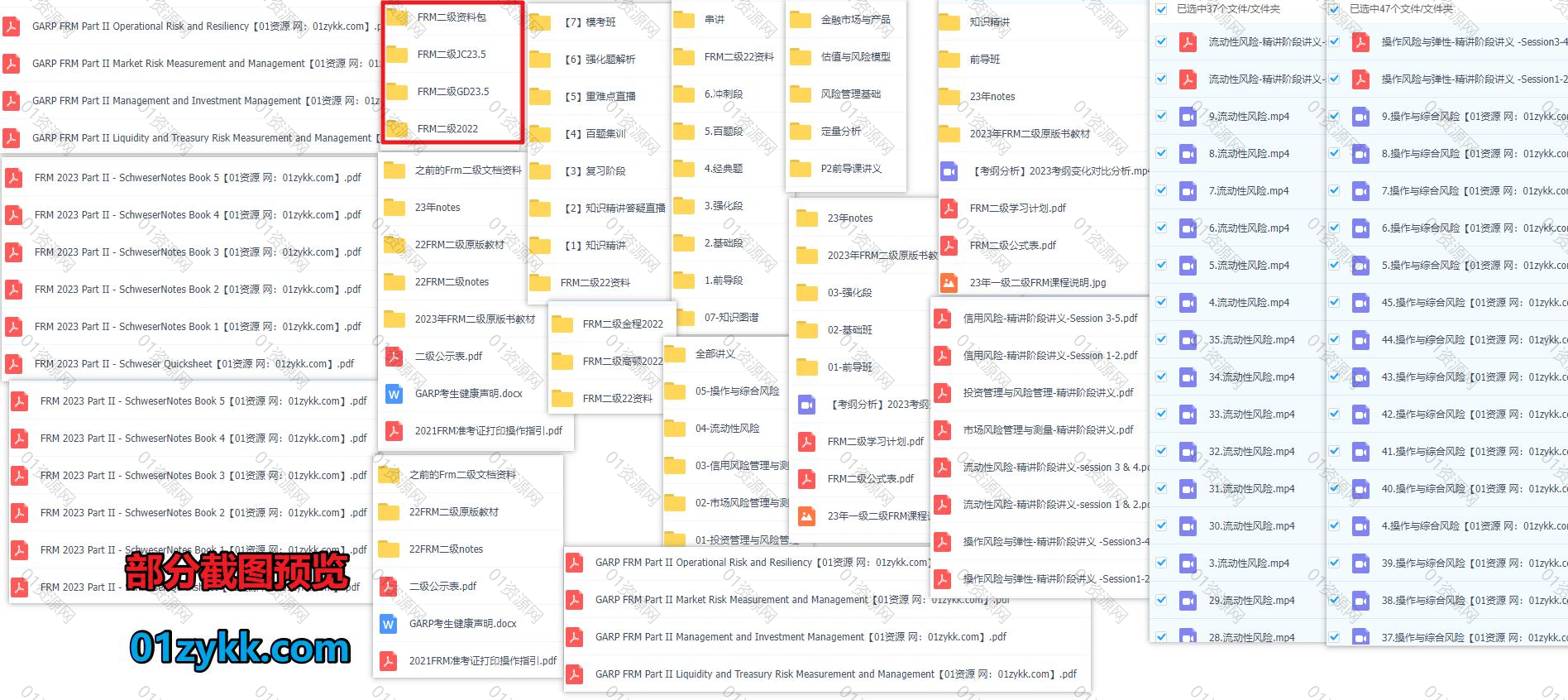

2023/22年FRM二级考试网课视频+电子版PDF讲义教材真题备考资料网盘合集,包含基础班/强化班/百题预测/经典题/知识精讲/课后习题…等

“考研考证”系列为01资源通过搜罗互联网整理而来的各类考研考证资源,覆盖面广,质量高。

◉ 找资源,就找01,公众号:01资源共享平台

🎁 点击成为VIP ☛ 一次性打包获取本站全部资源+赠送2000T网盘群组资源(涵盖考研/考证/外刊/各知识付费平台等)+01专属代找服务

◉ 找资源,就找01,微信号:xue36658

2023年FRM二级考试学习资料

本套资源收集整理了2023年FRM二级考试学习资料合集,包含23年/22年FRM二级备考网课视频+电子版PDF讲义教材真题等,双机构平台,百度网盘分享,持续收集中,涵盖基础班/强化班/百题预测/经典题/知识精讲/课后习题…等内容。

目录如下

【2023FRM二级+2022FRM二级】 [ 297.52GB ]

| |—— FRM二级金程23.5 [ 37.16GB ]

| | |—— 【考纲分析】2023考纲变化对比分析.mp4 [ 76.78MB ]

| | |—— FRM二级学习计划.pdf [ 116.22kB ]

| | |—— FRM二级公式表.pdf [ 265.64kB ]

| | |—— 23年一级二级FRM课程说明.jpg [ 8.94MB ]

| | |—— 23年notes [ 15.71MB ]

| | | |—— FRM 2023 Part II – SchweserNotes Book 5.pdf [ 2.95MB ]

| | | |—— FRM 2023 Part II – SchweserNotes Book 4.pdf [ 3.07MB ]

| | | |—— FRM 2023 Part II – SchweserNotes Book 3.pdf [ 2.91MB ]

| | | |—— FRM 2023 Part II – SchweserNotes Book 2.pdf [ 3.41MB ]

| | | |—— FRM 2023 Part II – SchweserNotes Book 1.pdf [ 2.95MB ]

| | | |—— FRM 2023 Part II – Schweser Quicksheet.pdf [ 430.57kB ]

| | |—— 2023年FRM二级原版书教材 [ 2.05GB ]

| | | |—— GARP FRM Part II Operational Risk and Resiliency.pdf [ 661.85MB ]

| | | |—— GARP FRM Part II Market Risk Measurement and Management.pdf [ 349.15MB ]

| | | |—— GARP FRM Part II Management and Investment Management.pdf [ 399.99MB ]

| | | |—— GARP FRM Part II Liquidity and Treasury Risk Measurement and Management.pdf [ 689.25MB ]

| | |—— 03-强化段 [ 5.46GB ]

| | | |—— 4.Risk Management and Investment Management [ 1.18GB ]

| | | | |—— 8.Hedge Funds.mp4 [ 293.70MB ]

| | | | |—— 7.Expand Portfolio Risk Management.mp4 [ 297.37MB ]

| | | | |—— 6.Portfolio VaR.mp4 [ 84.67MB ]

| | | | |—— 5.Active risk aversion.mp4 [ 78.93MB ]

| | | | |—— 4.Portfolio Construction.mp4 [ 85.85MB ]

| | | | |—— 3.Value and momenttum.mp4 [ 140.61MB ]

| | | | |—— 2.Factor Investing.mp4 [ 135.47MB ]

| | | | |—— 1.Factor Investing.mp4 [ 94.46MB ]

| | | | |—— 0.讲义 [ 1.73MB ]

| | | | | |—— 2.FRM二级强化段投资Cindy金程教育(打印版).pdf [ 487.64kB ]

| | | | | |—— 1.FRM二级强化段投资Cindy金程教育(标准版).pdf [ 1.26MB ]

| | | |—— 3.Liquidity and Treasury Risk Measurement and Management [ 1.47GB ]

| | | | |—— 9.Pricing Different Types of Deposits.mp4 [ 131.64MB ]

| | | | |—— 8.Biases on Returns .mp4 [ 82.06MB ]

| | | | |—— 7.Asset Management and Liability Management.mp4 [ 89.58MB ]

| | | | |—— 6.Three Approaches to LTP.mp4 [ 112.36MB ]

| | | | |—— 5.The structure of funds approach.mp4 [ 147.87MB ]

| | | | |—— 4.Manage Liquidity Risk.mp4 [ 120.84MB ]

| | | | |—— 3.Motivation of Repos.mp4 [ 159.39MB ]

| | | | |—— 2.Identify Trading Risk.mp4 [ 182.04MB ]

| | | | |—— 11.Interest Risk and Liquidity Phenomenon.mp4 [ 185.69MB ]

| | | | |—— 10.Measure and Monitor Liquidity Risk.mp4 [ 133.78MB ]

| | | | |—— 1.Identify and Understand Liquidity.mp4 [ 161.12MB ]

| | | | |—— 0.讲义 [ 3.47MB ]

| | | | | |—— 2.FRM二级强化段流动性Mikey金程教育(打印版).pdf [ 1.07MB ]

| | | | | |—— 1.FRM二级强化段流动性Mikey金程教育(标准版).pdf [ 2.40MB ]

| | | |—— 2.Market Risk Measurement and Management [ 1.63GB ]

| | | | |—— 9.Empirical Approaches to Risk Metrics and Hedges.mp4 [ 31.05MB ]

| | | | |—— 8.Modeling Dependence Correlations And Copulas.mp4 [ 197.61MB ]

| | | | |—— 7.Risk Measurement for the Trading Book.mp4 [ 89.72MB ]

| | | | |—— 6.VaR Mapping.mp4 [ 220.84MB ]

| | | | |—— 5.Conclusions.mp4 [ 83.77MB ]

| | | | |—— 4.Type 1 and Type 2 errors.mp4 [ 74.82MB ]

| | | | |—— 3.Backtesting VaR.mp4 [ 55.54MB ]

| | | | |—— 2.Extreme valu.mp4 [ 95.14MB ]

| | | | |—— 13.Volatility Smiles.mp4 [ 89.37MB ]

| | | | |—— 12.Term Structure Models of Interest Rates.mp4 [ 109.78MB ]

| | | | |—— 11.Term Structure Models of Interest Rates.mp4 [ 118.86MB ]

| | | | |—— 10.Term Structure Models of Interest Rates.mp4 [ 120.11MB ]

| | | | |—— 1.Estimating Market Risk Measures.mp4 [ 379.39MB ]

| | | | |—— 0.讲义 [ 2.10MB ]

| | | | | |—— FRM二级强化市场Crystal金程教育(电子版).pdf [ 1.44MB ]

| | | | | |—— FRM二级强化市场Crystal金程教育(打印版).pdf [ 677.04kB ]

| | | |—— 1.Credit Risk Measurement and Management [ 1.17GB ]

| | | | |—— FRM二级强化段信用风险Lindsey(打印版).pdf [ 678.98kB ]

| | | | |—— FRM二级强化段信用风险Lindsey(标准版).pdf [ 1.64MB ]

| | | | |—— 9.Securitization and Structured Product.mp4 [ 136.53MB ]

| | | | |—— 8.Credit Derivatives&Securitization&Retail Credit Risk.mp4 [ 115.07MB ]

| | | | |—— 7.Netting.mp4 [ 116.44MB ]

| | | | |—— 6.CVA and DVA.mp4 [ 119.10MB ]

| | | | |—— 5.Credit Risk Management.mp4 [ 110.88MB ]

| | | | |—— 4.Single Factor Model.mp4 [ 120.81MB ]

| | | | |—— 3.Credit Risk Measurement.mp4 [ 103.16MB ]

| | | | |—— 2.Credit Decision and Analyst.mp4 [ 135.16MB ]

| | | | |—— 10.Subprime Securitization.mp4 [ 115.05MB ]

| | | | |—— 1.Credit Risk Identification.mp4 [ 122.12MB ]

| | |—— 02-基础班 [ 28.61GB ]

| | | |—— 6.Risk Management and Investment Management(22的这科建议看高顿的) [ 3.59GB ]

| | | | |—— Crystal Gao [ 3.59GB ]

| | | | | |—— 【课时9】9.Performance Measurement 2~1.mp4 [ 335.90MB ]

| | | | | |—— 【课时8】8.Performance Measurement 1~1.mp4 [ 568.08MB ]

| | | | | |—— 【课时7】7.Portfolio Risk Management 2~1.mp4 [ 340.16MB ]

| | | | | |—— 【课时6】6.Portfolio Risk Management 1~1.mp4 [ 282.90MB ]

| | | | | |—— 【课时5】5.Portfolio VaR~1.mp4 [ 255.23MB ]

| | | | | |—— 【课时4】4.Portfolio Construction~1.mp4 [ 354.15MB ]

| | | | | |—— 【课时3】3.Alpha~1.mp4 [ 365.01MB ]

| | | | | |—— 【课时2】2.Factors~1.mp4 [ 314.26MB ]

| | | | | |—— 【课时1】1.Factor Theory~1.mp4 [ 341.46MB ]

| | | | | |—— 【课时10】10.Hedge Fund~1.mp4 [ 514.16MB ]

| | | | | |—— FRM二级基础段风险管理与投资管理_Crystal_金程教育(打印版).pdf [ 639.19kB ]

| | | | | |—— FRM二级基础段风险管理与投资管理_Crystal_金程教育(标准版).pdf [ 1.98MB ]

| | | |—— 5.Operational Risk and Resiliency(22的,建议这科看高顿的) [ 3.87GB ]

| | | | |—— Galina Liang [ 3.87GB ]

| | | | | |—— 【课时8】8. Cyber-Resilient and Operational Resilience~1.mp4 [ 802.76MB ]

| | | | | |—— 【课时7】7. Basel III Reforms and Finalization and Other Regulations~1.mp4 [ 389.42MB ]

| | | | | |—— 【课时6】6. Capital Regulation Before the Global Financial Crisis~1.mp4 [ 337.94MB ]

| | | | | |—— 【课时5】5. Economic Capital and Other Related Issues~1.mp4 [ 463.25MB ]

| | | | | |—— 【课时4】4. Validating Models and RAROC~1.mp4 [ 473.98MB ]

| | | | | |—— 【课时3】3. Operational Risk Data and Model Risk Management~1.mp4 [ 490.27MB ]

| | | | | |—— 【课时2】2.Enterprise Risk Management and RAF~1.mp4 [ 445.33MB ]

| | | | | |—— 【课时1】1. Revisions to the Principles for the Sound Management of Operational Risk~1.mp4 [ 555.83MB ]

| | | | | |—— FRM二级基础段操作Glina金程教育(打印版).pdf [ 793.30kB ]

| | | | | |—— FRM二级基础段操作Glina金程教育(标准版).pdf [ 2.18MB ]

| | | |—— 4.Current Issues [ 2.67GB ]

| | | | |—— 【课时8】The Rise of digital money~1.mp4 [ 178.77MB ]

| | | | |—— 【课时7】Climate-related risk drivers and their transmission channels~1.mp4 [ 419.82MB ]

| | | | |—— 【课时6】AI Risk & Governance~1.mp4 [ 168.45MB ]

| | | | |—— 【课时5】ML and AI for Risk Management~1.mp4 [ 225.83MB ]

| | | | |—— 【课时4】LIBOR transition Case studies for navigating conduct risks~1.mp4 [ 684.74MB ]

| | | | |—— 【课时3】Beyond LIBOR- a primer on the new benchmark rates~1.mp4 [ 332.76MB ]

| | | | |—— 【课时2】Holistic Review of the March Market Turmoil~1.mp4 [ 512.12MB ]

| | | | |—— 【课时1】Covid-19 and cyber risk in the financial sector~1.mp4 [ 203.85MB ]

| | | | |—— FRM二级基础段金融热点话题(三)打印版.pdf [ 625.95kB ]

| | | | |—— FRM二级基础段金融热点话题(三).pdf [ 2.16MB ]

| | | | |—— FRM二级基础段金融热点话题(二)打印版.pdf [ 285.55kB ]

| | | | |—— FRM二级基础段金融热点话题(二).pdf [ 493.91kB ]

| | | | |—— FRM二级基础段金融热点_金程教育(电子版).pdf [ 2.94MB ]

| | | | |—— FRM二级基础段金融热点_金程教育(打印版).pdf [ 813.23kB ]

| | | |—— 3.Liquidity and Treasury Risk Measurement and Management [ 4.60GB ]

| | | | |—— Mikey Chow [ 4.60GB ]

| | | | | |—— 【课时9】9.Liquidity Stress Testing~1.mp4 [ 123.73MB ]

| | | | | |—— 【课时8】8.The Failure Mechanics of Dealer Banks~1.mp4 [ 68.06MB ]

| | | | | |—— 【课时7】7.Monitoring Liquidity~1.mp4 [ 529.22MB ]

| | | | | |—— 【课时6】6.Intraday Liquidity Risk Management~1.mp4 [ 257.42MB ]

| | | | | |—— 【课时5】5.Liquidity and Reserves Management Strategies and Policies~1.mp4 [ 500.13MB ]

| | | | | |—— 【课时4】4.The Investment Function in Financial-Services Management~1.mp4 [ 328.30MB ]

| | | | | |—— 【课时3】3.Early Warning Indicators~1.mp4 [ 45.12MB ]

| | | | | |—— 【课时2】2.Liquidity and Leverage~1.mp4 [ 480.63MB ]

| | | | | |—— 【课时1】1.Liquidity Risk-1643449020~1.mp4 [ 535.34MB ]

| | | | | |—— 【课时19】19.Illiquid Assets~1.mp4 [ 268.51MB ]

| | | | | |—— 【课时18】18.Risk Management for Changing Interest Rates Asset-Liability Management and D~1.mp4 [ 341.90MB ]

| | | | | |—— 【课时17】17.Interest Parity Lost Understanding the Cross-Currency Basis~1.mp4 [ 96.47MB ]

| | | | | |—— 【课时16】16.The US Dollar Shortage in Global Banking and the International Policy Respons~1.mp4 [ 72.29MB ]

| | | | | |—— 【课时15】15.Liquidity Transfer Pricing A Guide to Better Practice~1.mp4 [ 185.99MB ]

| | | | | |—— 【课时14】14.Repurchase Agreements and Financing~1.mp4 [ 194.83MB ]

| | | | | |—— 【课时13】13.Managing Nondeposit Liabilities~1.mp4 [ 256.96MB ]

| | | | | |—— 【课时12】12.Managing and Pricing Deposit Services~1.mp4 [ 270.78MB ]

| | | | | |—— 【课时11】11.Contingency Funding Planning~1.mp4 [ 91.14MB ]

| | | | | |—— 【课时10】10.Liquidity Risk Reporting and Stress Testing~1.mp4 [ 57.32MB ]

| | | | | |—— FRM二级基础段流动性Mikey金程教育(打印版).pdf [ 1.73MB ]

| | | | | |—— FRM二级基础段流动性Mikey金程教育(标准版).pdf [ 3.97MB ]

| | | |—— 2.Market Risk Measurement and Management [ 7.06GB ]

| | | | |—— Mikey Chow [ 4.36GB ]

| | | | | |—— FRM二级基础段市场风险Mikey(打印版).pdf [ 1.26MB ]

| | | | | |—— FRM二级基础段市场风险Mikey(标准版).pdf [ 2.86MB ]

| | | | | |—— 9.Financial Correlation Modeling.mp4 [ 219.80MB ]

| | | | | |—— 8.Empirical Properties of Correlation.mp4 [ 167.36MB ]

| | | | | |—— 7.Some Correlation Basics.mp4 [ 332.66MB ]

| | | | | |—— 6.Risk Measurement for the Trading Book.mp4 [ 571.06MB ]

| | | | | |—— 5.VaR Mapping.mp4 [ 541.62MB ]

| | | | | |—— 4.Backtesting VaR.mp4 [ 578.70MB ]

| | | | | |—— 3.Extreme valu.mp4 [ 229.76MB ]

| | | | | |—— 2.Non-parametric Approaches.mp4 [ 594.95MB ]

| | | | | |—— 14.Volatility Smiles.mp4 [ 191.02MB ]

| | | | | |—— 13.The Art of Term Structure Models Drift & Volatility and Distribution.mp4 [ 263.78MB ]

| | | | | |—— 12.The Evolution of Short Rates and the Shape of the Term Structur.mp4 [ 87.20MB ]

| | | | | |—— 11.The Science of Term Structure Models.mp4 [ 261.24MB ]

| | | | | |—— 10.Empirical Approaches to Risk Metrics and Hedges.mp4 [ 161.94MB ]

| | | | | |—— 1.Parametric Approaches.mp4 [ 263.79MB ]

| | | | |—— Crystal [ 2.70GB ]

| | | | | |—— 【课时9】9.Financial Correlation Modeling.mp4 [ 80.41MB ]

| | | | | |—— 【课时8】8.Empirical Properties of Correlation.mp4 [ 66.74MB ]

| | | | | |—— 【课时7】7.Some Correlation Basics.mp4 [ 238.72MB ]

| | | | | |—— 【课时6】6.Risk Measurement for the Trading Book.mp4 [ 286.93MB ]

| | | | | |—— 【课时5】5.VaR Mapping.mp4 [ 280.36MB ]

| | | | | |—— 【课时4】4.Backtesting VaR.mp4 [ 259.39MB ]

| | | | | |—— 【课时3】3.Extreme valu.mp4 [ 163.36MB ]

| | | | | |—— 【课时2】2.Non-parametric Approaches.mp4 [ 474.10MB ]

| | | | | |—— 【课时1】1.Parametric Approaches.mp4 [ 206.63MB ]

| | | | | |—— 【课时14】14.Volatility Smiles.mp4 [ 146.48MB ]

| | | | | |—— 【课时13】13.The Art of Term Structure Models Drift & Volatility and Distribution.mp4 [ 294.17MB ]

| | | | | |—— 【课时12】12.The Evolution of Short Rates and the Shape of the Term Structur.mp4 [ 35.71MB ]

| | | | | |—— 【课时11】11.The Science of Term Structure Models.mp4 [ 155.48MB ]

| | | | | |—— 【课时10】10.Empirical Approaches to Risk Metrics and Hedges.mp4 [ 67.59MB ]

| | | | | |—— FRM二级基础段市场风险Crystal(打印版).pdf [ 1.04MB ]

| | | | | |—— FRM二级基础段市场风险Crystal(标准版).pdf [ 6.08MB ]

| | | |—— 1.Credit Risk Measurement and Management [ 6.83GB ]

| | | | |—— Lindsey Yang [ 6.83GB ]

| | | | | |—— FRM二级基础段信用风险_Lindsey_金程教育-打印版.pdf [ 1.66MB ]

| | | | | |—— FRM二级基础段信用风险_Lindsey_金程教育-标准版.pdf [ 2.97MB ]

| | | | | |—— 4.FRM二级信用知识框架_Lindsey(标准版).pdf [ 715.03kB ]

| | | | | |—— 3.FRM二级信用知识框架_Lindsey(打印版).pdf [ 270.35kB ]

| | | | | |—— 2.FRM二级基础段信用风险_Lindsey_金程教育.pdf [ 1.65MB ]

| | | | | |—— 12-Retail Credit Risk Management.mp4 [ 299.98MB ]

| | | | | |—— 11-Securitization 2.mp4 [ 1.05GB ]

| | | | | |—— 10-Securitization 1.mp4 [ 548.10MB ]

| | | | | |—— 1.FRM二级基础段信用风险_Lindsey_金程教育.pdf [ 4.17MB ]

| | | | | |—— 09-Credit Derivatives.mp4 [ 298.89MB ]

| | | | | |—— 08-Mitigation of Counterparty Risk.mp4 [ 989.83MB ]

| | | | | |—— 07-Counterparty Risk 2.mp4 [ 575.38MB ]

| | | | | |—— 06-Counterparty Risk 1.mp4 [ 475.20MB ]

| | | | | |—— 05-Credit Exposur.mp4 [ 277.83MB ]

| | | | | |—— 04-Probability of Default 2.mp4 [ 268.18MB ]

| | | | | |—— 03-Probability of Default 1.mp4 [ 1.01GB ]

| | | | | |—— 02-Introduction of Credit Risk 2.mp4 [ 460.59MB ]

| | | | | |—— 01-Introduction of Credit Risk 1.mp4 [ 670.71MB ]

| | |—— 01-前导班 [ 963.17MB ]

| | | |—— FRM二级前导段框架介绍_Crystal_金程教育(打印版).pdf [ 564.71kB ]

| | | |—— FRM二级前导段框架介绍_Crystal_金程教育(标准版).pdf [ 979.80kB ]

| | | |—— 1.框架介绍 [ 961.66MB ]

| | | | |—— 【课时4】FRM二级前导-流动性风险与投资组合管理.mp4 [ 261.83MB ]

| | | | |—— 【课时3】FRM二级前导-操作风险.mp4 [ 254.08MB ]

| | | | |—— 【课时2】FRM二级前导-信用风险.mp4 [ 179.34MB ]

| | | | |—— 【课时1】FRM二级前导-市场风险.mp4 [ 266.42MB ]

| |—— FRM二级高顿23.5 [ 72.84GB ]

| | |—— 【考纲分析】2023考纲变化对比分析.mp4 [ 76.78MB ]

| | |—— FRM二级学习计划.pdf [ 116.22kB ]

| | |—— FRM二级公式表.pdf [ 265.64kB ]

| | |—— 23年一级二级FRM课程说明.jpg [ 8.94MB ]

| | |—— 知识精讲 [ 70.25GB ]

| | | |—— 全部讲义 [ 494.60MB ]

| | | | |—— 信用风险-精讲阶段讲义-Session 3-5.pdf [ 59.71MB ]

| | | | |—— 信用风险-精讲阶段讲义-Session 1-2.pdf [ 48.23MB ]

| | | | |—— 投资管理与风险管理-精讲阶段讲义.pdf [ 68.47MB ]

| | | | |—— 市场风险管理与测量-精讲阶段讲义.pdf [ 59.06MB ]

| | | | |—— 流动性风险-精讲阶段讲义-session 3 & 4.pdf [ 59.38MB ]

| | | | |—— 流动性风险-精讲阶段讲义-session 1 & 2.pdf [ 54.22MB ]

| | | | |—— 操作风险与弹性-精讲阶段讲义 -Session3-4.pdf [ 64.38MB ]

| | | | |—— 操作风险与弹性-精讲阶段讲义 -Session1-2.pdf [ 81.15MB ]

| | | |—— 05-操作与综合风险 [ 11.52GB ]

| | | | |—— 操作风险与弹性-精讲阶段讲义 -Session3-4.pdf [ 64.38MB ]

| | | | |—— 操作风险与弹性-精讲阶段讲义 -Session1-2.pdf [ 81.15MB ]

| | | | |—— 9.操作与综合风险.mp4 [ 339.78MB ]

| | | | |—— 8.操作与综合风险.mp4 [ 226.83MB ]

| | | | |—— 7.操作与综合风险.mp4 [ 268.43MB ]

| | | | |—— 6.操作与综合风险.mp4 [ 185.79MB ]

| | | | |—— 5.操作与综合风险.mp4 [ 180.68MB ]

| | | | |—— 45.操作与综合风险.mp4 [ 302.21MB ]

| | | | |—— 44.操作与综合风险.mp4 [ 186.22MB ]

| | | | |—— 43.操作与综合风险.mp4 [ 260.04MB ]

| | | | |—— 42.操作与综合风险.mp4 [ 282.67MB ]

| | | | |—— 41.操作与综合风险.mp4 [ 413.88MB ]

| | | | |—— 40.操作与综合风险.mp4 [ 124.49MB ]

| | | | |—— 4.操作与综合风险.mp4 [ 151.05MB ]

| | | | |—— 39.操作与综合风险.mp4 [ 362.07MB ]

| | | | |—— 38.操作与综合风险.mp4 [ 203.65MB ]

| | | | |—— 37.操作与综合风险.mp4 [ 171.18MB ]

| | | | |—— 36.操作与综合风险.mp4 [ 269.03MB ]

| | | | |—— 35.操作与综合风险.mp4 [ 192.31MB ]

| | | | |—— 34.操作与综合风险.mp4 [ 287.89MB ]

| | | | |—— 33.操作与综合风险.mp4 [ 256.11MB ]

| | | | |—— 32.操作与综合风险.mp4 [ 319.81MB ]

| | | | |—— 31.操作与综合风险.mp4 [ 232.22MB ]

| | | | |—— 30.操作与综合风险.mp4 [ 207.21MB ]

| | | | |—— 3.操作与综合风险.mp4 [ 273.77MB ]

| | | | |—— 29.操作与综合风险.mp4 [ 219.10MB ]

| | | | |—— 28.操作与综合风险.mp4 [ 299.27MB ]

| | | | |—— 27.操作与综合风险.mp4 [ 310.26MB ]

| | | | |—— 26.操作与综合风险.mp4 [ 365.05MB ]

| | | | |—— 25.操作与综合风险.mp4 [ 115.72MB ]

| | | | |—— 24.操作与综合风险.mp4 [ 224.31MB ]

| | | | |—— 23.操作与综合风险.mp4 [ 209.36MB ]

| | | | |—— 22.操作与综合风险.mp4 [ 144.38MB ]

| | | | |—— 21.操作与综合风险.mp4 [ 374.99MB ]

| | | | |—— 20.操作与综合风险.mp4 [ 170.85MB ]

| | | | |—— 2.操作与综合风险.mp4 [ 313.23MB ]

| | | | |—— 19.操作与综合风险.mp4 [ 200.28MB ]

| | | | |—— 18.操作与综合风险.mp4 [ 192.96MB ]

| | | | |—— 17.操作与综合风险.mp4 [ 188.40MB ]

| | | | |—— 16.操作与综合风险.mp4 [ 355.27MB ]

| | | | |—— 15.操作与综合风险.mp4 [ 451.21MB ]

| | | | |—— 14.操作与综合风险.mp4 [ 457.61MB ]

| | | | |—— 13.操作与综合风险.mp4 [ 310.24MB ]

| | | | |—— 12.操作与综合风险.mp4 [ 191.65MB ]

| | | | |—— 11.操作与综合风险.mp4 [ 248.18MB ]

| | | | |—— 10.操作与综合风险.mp4 [ 260.53MB ]

| | | | |—— 1.操作与综合风险.mp4 [ 352.34MB ]

| | | |—— 04-流动性风险 [ 9.77GB ]

| | | | |—— 流动性风险-精讲阶段讲义-session 3 & 4.pdf [ 59.38MB ]

| | | | |—— 流动性风险-精讲阶段讲义-session 1 & 2.pdf [ 54.22MB ]

| | | | |—— 9.流动性风险.mp4 [ 373.42MB ]

| | | | |—— 8.流动性风险.mp4 [ 297.86MB ]

| | | | |—— 7.流动性风险.mp4 [ 183.78MB ]

| | | | |—— 6.流动性风险.mp4 [ 287.01MB ]

| | | | |—— 5.流动性风险.mp4 [ 304.62MB ]

| | | | |—— 4.流动性风险.mp4 [ 240.70MB ]

| | | | |—— 35.流动性风险.mp4 [ 253.39MB ]

| | | | |—— 34.流动性风险.mp4 [ 121.38MB ]

| | | | |—— 33.流动性风险.mp4 [ 158.59MB ]

| | | | |—— 32.流动性风险.mp4 [ 114.18MB ]

| | | | |—— 31.流动性风险.mp4 [ 197.24MB ]

| | | | |—— 30.流动性风险.mp4 [ 207.92MB ]

| | | | |—— 3.流动性风险.mp4 [ 458.97MB ]

| | | | |—— 29.流动性风险.mp4 [ 426.36MB ]

| | | | |—— 28.流动性风险.mp4 [ 256.92MB ]

| | | | |—— 27.流动性风险.mp4 [ 611.54MB ]

| | | | |—— 26.流动性风险.mp4 [ 390.18MB ]

| | | | |—— 25.流动性风险.mp4 [ 179.65MB ]

| | | | |—— 24.流动性风险.mp4 [ 627.95MB ]

| | | | |—— 23.流动性风险.mp4 [ 337.24MB ]

| | | | |—— 22.流动性风险.mp4 [ 188.04MB ]

| | | | |—— 21.流动性风险.mp4 [ 263.34MB ]

| | | | |—— 20.流动性风险.mp4 [ 106.00MB ]

| | | | |—— 2.流动性风险.mp4 [ 282.18MB ]

| | | | |—— 19.流动性风险.mp4 [ 269.34MB ]

| | | | |—— 18.流动性风险.mp4 [ 93.57MB ]

| | | | |—— 17.流动性风险.mp4 [ 290.19MB ]

| | | | |—— 16.流动性风险.mp4 [ 282.18MB ]

| | | | |—— 15.流动性风险.mp4 [ 300.78MB ]

| | | | |—— 14.流动性风险.mp4 [ 275.90MB ]

| | | | |—— 13.流动性风险.mp4 [ 496.16MB ]

| | | | |—— 12.流动性风险.mp4 [ 256.12MB ]

| | | | |—— 11.流动性风险.mp4 [ 307.21MB ]

| | | | |—— 10.流动性风险.mp4 [ 232.67MB ]

| | | | |—— 1.流动性风险.mp4 [ 223.30MB ]

| | | |—— 03-信用风险管理与测量 [ 21.73GB ]

| | | | |—— Gloria [ 21.73GB ]

| | | | | |—— 信用风险-精讲阶段讲义-Session 3-5.pdf [ 59.71MB ]

| | | | | |—— 信用风险-精讲阶段讲义-Session 1-2.pdf [ 48.23MB ]

| | | | | |—— 9.Merton Model(2).mp4 [ 839.74MB ]

| | | | | |—— 8.Merton Model(1).mp4 [ 840.22MB ]

| | | | | |—— 7.credit ratings.mp4 [ 789.96MB ]

| | | | | |—— 6.defineltion related to PD.mp4 [ 623.79MB ]

| | | | | |—— 5.the credit analyst.mp4 [ 416.24MB ]

| | | | | |—— 43.课程总结.mp4 [ 90.06MB ]

| | | | | |—— 43.multifactor and EMH.mp4 [ 356.76MB ]

| | | | | |—— 42.Seven Frictions of Securitization Process.mp4 [ 455.43MB ]

| | | | | |—— 41.Cash flows in Securitization Structur.mp4 [ 612.52MB ]

| | | | | |—— 40-Strutured products(2).mp4 [ 220.40MB ]

| | | | | |—— 39. Structured products(1).mp4 [ 485.82MB ]

| | | | | |—— 38.Asset pools.mp4 [ 513.37MB ]

| | | | | |—— 37.The process of Securitization.mp4 [ 502.82MB ]

| | | | | |—— 36.Other Credit Derivatives.mp4 [ 607.46MB ]

| | | | | |—— 35.Credit Default Swa.mp4 [ 569.19MB ]

| | | | | |—— 34.Stress Test for Counterparty Exposures.mp4 [ 239.85MB ]

| | | | | |—— 33.CVA pricing and allocation(2).mp4 [ 805.07MB ]

| | | | | |—— 32.CVA pricing and Allocation(1).mp4 [ 445.17MB ]

| | | | | |—— 31.Credit Valuation Adjustment and xVA.mp4 [ 445.14MB ]

| | | | | |—— 30.Margin (collateral)(2).mp4 [ 677.66MB ]

| | | | | |—— 3.componens of credit risk.mp4 [ 420.64MB ]

| | | | | |—— 29.Margin (collateral)(1).mp4 [ 776.98MB ]

| | | | | |—— 28.Netting,close_out (2).mp4 [ 442.19MB ]

| | | | | |—— 27.Netting,close_out (1).mp4 [ 736.90MB ]

| | | | | |—— 26.wrong way risk and right_way risk.mp4 [ 602.16MB ]

| | | | | |—— 25.Basics of Counterparty Risk.mp4 [ 360.98MB ]

| | | | | |—— 24.single factor model.mp4 [ 499.09MB ]

| | | | | |—— 23.credit risk portfolio models.mp4 [ 524.50MB ]

| | | | | |—— 22.credit var default correlation.mp4 [ 681.07MB ]

| | | | | |—— 21.unexpected loss.mp4 [ 534.57MB ]

| | | | | |—— 20.Exposure profile of various securities.mp4 [ 551.24MB ]

| | | | | |—— 2.前情提要.mp4 [ 184.30MB ]

| | | | | |—— 19.Metrics for Credit Exposur.mp4 [ 360.98MB ]

| | | | | |—— 18. Heuristic and Numerical Approaches.mp4 [ 350.25MB ]

| | | | | |—— 17.Statistical_based Models(2).mp4 [ 404.65MB ]

| | | | | |—— 16.Statistical_based Models(1).mp4 [ 511.18MB ]

| | | | | |—— 15.Credit Scoring.mp4 [ 624.10MB ]

| | | | | |—— 14.Retail Credit Risk.mp4 [ 425.96MB ]

| | | | | |—— 13.Spread and Hazard Rate(2).mp4 [ 421.36MB ]

| | | | | |—— 12.Spread and Hazard Rate(1).mp4 [ 596.56MB ]

| | | | | |—— 11.Default Intensity Models.mp4 [ 554.59MB ]

| | | | | |—— 10.KMV Model.mp4 [ 320.60MB ]

| | | | | |—— 1. Credit Risk Measurement and Management.mp4 [ 62.70MB ]

| | | | | |—— 04-credit analysis.mp4 [ 489.51MB ]

| | | | | |—— 0. Introduction.mp4 [ 166.11MB ]

| | | |—— 02-市场风险管理与测量 [ 15.45GB ]

| | | | |—— FRM P2网课 市场风险管理与测量.pdf [ 59.04MB ]

| | | | |—— 26-Volatility Smiles.mp4 [ 761.37MB ]

| | | | |—— 25-Empirical Approaches to Risk Metrics and Hedges.mp4 [ 454.99MB ]

| | | | |—— 24-Fundamantal Review of Trading Book.mp4 [ 430.41MB ]

| | | | |—— 23-Messages from the Academic Literature on Risk Measurement for the Trading Book_01.mp4 [ 659.10MB ]

| | | | |—— 22-Volatility and Distribution.mp4 [ 498.25MB ]

| | | | |—— 21-The Art of Term Structure Models Drift (2).mp4 [ 624.59MB ]

| | | | |—— 20-The Art of Term Structure Models Drift (1).mp4 [ 879.57MB ]

| | | | |—— 19-The Shape of the Term Structur.mp4 [ 878.96MB ]

| | | | |—— 18-Issues With Interest Rate Tree Model.mp4 [ 429.02MB ]

| | | | |—— 17-Binomial Interest Rate Tree Model.mp4 [ 1.18GB ]

| | | | |—— 16-Financial Correlation Modeling.mp4 [ 438.65MB ]

| | | | |—— 15-Empirical Properties of Correlation.mp4 [ 435.40MB ]

| | | | |—— 14-Some Correlation Basics(2).mp4 [ 462.36MB ]

| | | | |—— 13-Some Correlation Basics(1).mp4 [ 769.34MB ]

| | | | |—— 12-VaR Mapping:Application(2).mp4 [ 440.74MB ]

| | | | |—— 11-VaR Mapping:Application(1).mp4 [ 601.36MB ]

| | | | |—— 10-VaR MappingRisk Factor.mp4 [ 389.81MB ]

| | | | |—— 09-Backtesting VaR (2).mp4 [ 888.43MB ]

| | | | |—— 08-Backtesting VaR (1).mp4 [ 763.22MB ]

| | | | |—— 07-POT peaks-over-threshold approach.mp4 [ 623.61MB ]

| | | | |—— 06-GEV generalized extreme-value theory.mp4 [ 464.32MB ]

| | | | |—— 05-Weighted Historical Simulation.mp4 [ 876.97MB ]

| | | | |—— 04-Historical Simulation.mp4 [ 180.69MB ]

| | | | |—— 03-Coherent Risk Measures.mp4 [ 554.74MB ]

| | | | |—— 02-Basic Methods of VaR Estimation.mp4 [ 656.63MB ]

| | | | |—— 01-Introduction of Market Risk Measurement and Management.mp4 [ 392.66MB ]

| | | |—— 01-投资管理与风险管理 [ 11.29GB ]

| | | | |—— FRM P2网课 投资管理与风险管理.pdf [ 59.85MB ]

| | | | |—— 29-finding bernie madoff detecting fraud by investment managers.mp4 [ 440.69MB ]

| | | | |—— 28-performing due diligence on specific managers and funds.mp4 [ 501.87MB ]

| | | | |—— 27-risks in hedge funds.mp4 [ 172.03MB ]

| | | | |—— 26-hedge funds strategies(1).mp4 [ 501.89MB ]

| | | | |—— 25-hedge funds strategies(1).mp4 [ 334.00MB ]

| | | | |—— 24-characteristics of hedge funds.mp4 [ 482.74MB ]

| | | | |—— 23-performance attribution.mp4 [ 408.65MB ]

| | | | |—— 22-market timing.mp4 [ 310.94MB ]

| | | | |—— 21-conventional theory(2).mp4 [ 330.50MB ]

| | | | |—— 20-conventional theory(1).mp4 [ 518.26MB ]

| | | | |—— 19-RMUs&performance measurement.mp4 [ 186.45MB ]

| | | | |—— 18-three-legged risk management stool.mp4 [ 141.75MB ]

| | | | |—— 17-risk budgeting(2).mp4 [ 377.73MB ]

| | | | |—— 16-risk budgeting(1).mp4 [ 251.37MB ]

| | | | |—— 15-specific risks in investment management(2).mp4 [ 325.45MB ]

| | | | |—— 14-specific risks in investment management(1).mp4 [ 390.97MB ]

| | | | |—— 13-using VaR for risk management.mp4 [ 325.00MB ]

| | | | |—— 12-portfolio VaR measures.mp4 [ 794.67MB ]

| | | | |—— 11-portfolio construction techniques.mp4 [ 359.09MB ]

| | | | |—— 10-inputs for portfolio construction(2).mp4 [ 334.59MB ]

| | | | |—— 09-inputs for portfolio construction(1).mp4 [ 623.88MB ]

| | | | |—— 08-benchmarker matters.mp4 [ 696.95MB ]

| | | | |—— 07-active management.mp4 [ 318.11MB ]

| | | | |—— 06-dynamic factors.mp4 [ 650.97MB ]

| | | | |—— 05-macro factors.mp4 [ 493.31MB ]

| | | | |—— 04-multifactor and EMH.mp4 [ 362.44MB ]

| | | | |—— 03-factor theory and CAPM (2).mp4 [ 255.63MB ]

| | | | |—— 02-factor theory and CAPM (1).mp4 [ 435.60MB ]

| | | | |—— 01-Introduction.mp4 [ 174.84MB ]

| | |—— 前导班 [ 458.10MB ]

| | | |—— 金融市场与产品 [ 126.31MB ]

| | | | |—— 04 Central Counterparties [ 21.35MB ]

| | | | | |—— 4.P2前导Central Counterparties.mp4 [ 21.35MB ]

| | | | |—— 03 Fund Management [ 30.56MB ]

| | | | | |—— 3.P2前导Fund Management.mp4 [ 30.56MB ]

| | | | |—— 02 Black_Scholes_Merton Model [ 25.01MB ]

| | | | | |—— 2.P2前导Black_Scholes_Merton Model.mp4 [ 25.01MB ]

| | | | |—— 01 Binomial Trees [ 49.39MB ]

| | | | | |—— 1.P2前导Binomial Trees.mp4 [ 49.39MB ]

| | | |—— 估值与风险模型 [ 119.44MB ]

| | | | |—— 05 Operation risk [ 20.59MB ]

| | | | | |—— 5.P2前导Operation risk.mp4 [ 20.59MB ]

| | | | |—— 04 Credit risk [ 21.77MB ]

| | | | | |—— 4.P2前导 Credit risk.mp4 [ 21.77MB ]

| | | | |—— 03 Market risk [ 26.29MB ]

| | | | | |—— 3.P2前导 Market risk.mp4 [ 26.29MB ]

| | | | |—— 02 Duration [ 15.66MB ]

| | | | | |—— 2.P2前导Duration.mp4 [ 15.66MB ]

| | | | |—— 01 Interest rates [ 35.14MB ]

| | | | | |—— 1.P2前导Interest rates.mp4 [ 35.14MB ]

| | | |—— 风险管理基础 [ 85.82MB ]

| | | | |—— 03 The Arbitrage Pricing Theory [ 28.82MB ]

| | | | | |—— 3.P2前导The Arbitrage Pricing Theory-.mp4 [ 28.82MB ]

| | | | |—— 02 Capital Asset Pricing Model [ 30.74MB ]

| | | | | |—— 2.P2前导Capital Asset Pricing Model.mp4 [ 30.74MB ]

| | | | |—— 01 Modern Portfolio Theory [ 26.25MB ]

| | | | | |—— 1.P2前导Modern Portoflio Theory.mp4 [ 26.25MB ]

| | | |—— 定量分析 [ 92.22MB ]

| | | | |—— 04 Return Volatility and correlation [ 21.43MB ]

| | | | | |—— 4.P2前导 Return Volatility and correlation-.mp4 [ 21.43MB ]

| | | | |—— 03 Hypothesis testing [ 23.87MB ]

| | | | | |—— 3.P2前导-Hypothesis testing.mp4 [ 23.87MB ]

| | | | |—— 02 Distributions [ 23.92MB ]

| | | | | |—— 2.P2前导-Distributions-.mp4 [ 23.92MB ]

| | | | |—— 01 Basic Concepts of Probability [ 23.01MB ]

| | | | | |—— 1.P2前导-Basic Concepts of Probability.mp4 [ 23.01MB ]

| | | |—— P2前导课讲义 [ 34.31MB ]

| | | | |—— P2前导-P1B4.pdf [ 10.19MB ]

| | | | |—— P2前导-P1B3.pdf [ 11.00MB ]

| | | | |—— P2前导-P1B2.pdf [ 6.26MB ]

| | | | |—— P2前导-P1B1.pdf [ 6.86MB ]

| | |—— 23年notes [ 15.71MB ]

| | | |—— FRM 2023 Part II – SchweserNotes Book 5.pdf [ 2.95MB ]

| | | |—— FRM 2023 Part II – SchweserNotes Book 4.pdf [ 3.07MB ]

| | | |—— FRM 2023 Part II – SchweserNotes Book 3.pdf [ 2.91MB ]

| | | |—— FRM 2023 Part II – SchweserNotes Book 2.pdf [ 3.41MB ]

| | | |—— FRM 2023 Part II – SchweserNotes Book 1.pdf [ 2.95MB ]

| | | |—— FRM 2023 Part II – Schweser Quicksheet.pdf [ 430.57kB ]

| | |—— 2023年FRM二级原版书教材 [ 2.05GB ]

| | | |—— GARP FRM Part II Operational Risk and Resiliency.pdf [ 661.85MB ]

| | | |—— GARP FRM Part II Market Risk Measurement and Management.pdf [ 349.15MB ]

| | | |—— GARP FRM Part II Management and Investment Management.pdf [ 399.99MB ]

| | | |—— GARP FRM Part II Liquidity and Treasury Risk Measurement and Management.pdf [ 689.25MB ]

| |—— FRM二级2022 [ 178.96GB ]

| | |—— FRM二级金程2022 [ 135.89GB ]

| | | |—— 串讲 [ 5.06GB ]

| | | | |—— 【F2 金 串讲框架】3.信用风险科目串讲-Lindsey.mp4 [ 256.34MB ]

| | | | |—— 【F2 金 串讲框架】2.市场风险科目串讲-Crystal.mp4 [ 222.59MB ]

| | | | |—— 2.FRM二级流动性知识框架Alex(打印版).pdf [ 597.56kB ]

| | | | |—— 1.FRM二级流动性知识框架Alex(标准版).pdf [ 1.03MB ]

| | | | |—— 7.【名师带学】操作风险 [ 1.73GB ]

| | | | | |—— 【课时1】FRM二级名师带学-周琪-操作风险.mp4 [ 1.73GB ]

| | | | |—— 6.【名师带学】流动性风险 [ 1.11GB ]

| | | | | |—— 【课时1】FRM二级名师带学-流动性风险-姚奕-流动性风险.mp4 [ 1.11GB ]

| | | | |—— 10.【名师带学】投资管理 [ 1.75GB ]

| | | | | |—— 【课时1】FRM二级名师带学-投资-吴帆-FRM二级基础段科目串讲风险管理和投资管理-Cindy.mp4 [ 1.75GB ]

| | | |—— FRM二级22资料 [ 6.49GB ]

| | | | |—— 二级公示表.pdf [ 1.42MB ]

| | | | |—— GARP考生健康声明.docx [ 214.79kB ]

| | | | |—— 2021FRM准考证打印操作指引.pdf [ 289.27kB ]

| | | | |—— 之前的Frm二级文档资料 [ 4.81GB ]

| | | | | |—— 文档资料 [ 2.64GB ]

| | | | | | |—— FRM二级学习计划.pdf [ 119.85kB ]

| | | | | | |—— FRM二级信用风险学习笔记.pdf [ 162.53kB ]

| | | | | | |—— FRM二级公式表.pdf [ 266.65kB ]

| | | | | | |—— FRM二级风险管理与投资管理科目笔记.pdf [ 69.02MB ]

| | | | | | |—— FRM二级操作风险学习笔记.pdf [ 264.23kB ]

| | | | | | |—— FRM二级操作风险测量与管理科目笔记.pdf [ 87.40MB ]

| | | | | | |—— FRM2级notes1.pdf [ 40.04MB ]

| | | | | | |—— 官方新题+考纲 [ 8.48MB ]

| | | | | | | |—— 2020年最新协会模考题Mock.pdf [ 3.05MB ]

| | | | | | | |—— 2020年最新FRM考纲.pdf [ 956.15kB ]

| | | | | | | |—— 2020年五月考试水平测试题.pdf [ 1.04MB ]

| | | | | | | |—— 2020年P2最新协会模考题Mock.pdf [ 2.53MB ]

| | | | | | | |—— 2020年P2水平测试题.pdf [ 956.61kB ]

| | | | | | |—— Henry Liang FRM Guide [ 24.06MB ]

| | | | | | | |—— Version Control.txt [ 265B ]

| | | | | | | |—— Henry Liang’s FRM Guide II.pdf [ 4.78MB ]

| | | | | | | |—— Henry Liang’s FRM Guide I.pdf [ 19.28MB ]

| | | | | | |—— FRM 2020 SchweserNotes Part II [ 247.25MB ]

| | | | | | | |—— FRM 2020 SchweserNotes Part II Book 5.pdf [ 47.51MB ]

| | | | | | | |—— FRM 2020 SchweserNotes Part II Book 4.pdf [ 49.96MB ]

| | | | | | | |—— FRM 2020 SchweserNotes Part II Book 3.pdf [ 62.20MB ]

| | | | | | | |—— FRM 2020 SchweserNotes Part II Book 2.pdf [ 53.72MB ]

| | | | | | | |—— FRM 2020 SchweserNotes Part II Book 1.pdf [ 33.86MB ]

| | | | | | |—— 21年FRM一级notes等多个文件 [ 48.88MB ]

| | | | | | | |—— 2021年FRM二级Notes [ 48.88MB ]

| | | | | | | | |—— FRM 2021 SchweserNotes Part II Book 5.pdf [ 7.36MB ]

| | | | | | | | |—— FRM 2021 SchweserNotes Part II Book 4.pdf [ 12.75MB ]

| | | | | | | | |—— FRM 2021 SchweserNotes Part II Book 3.pdf [ 9.48MB ]

| | | | | | | | |—— FRM 2021 SchweserNotes Part II Book 2.pdf [ 8.45MB ]

| | | | | | | | |—— FRM 2021 SchweserNotes Part II Book 1.pdf [ 6.84MB ]

| | | | | | | | |—— FRM 2021 Schweser Quicksheet Part II.pdf [ 4.00MB ]

| | | | | | |—— 21年FRM二级教材 [ 248.41MB ]

| | | | | | | |—— 5. Risk Management and Investment Management.pdf [ 33.32MB ]

| | | | | | | |—— 4. Liquidity and Treasury Risk Measurement and Management.pdf [ 57.57MB ]

| | | | | | | |—— 3. Operational Risk and Resiliency.pdf [ 65.15MB ]

| | | | | | | |—— 2. Credit Risk Measurement and Management.pdf [ 63.49MB ]

| | | | | | | |—— 1. Market Risk Measurement and Management.pdf [ 28.88MB ]

| | | | | | |—— 2020年二级FRM教材 [ 1.88GB ]

| | | | | | | |—— book5-Liquidity and Treasury Risk Measurement and Management.pdf [ 602.64MB ]

| | | | | | | |—— book4-Operational Risk and Resiliency(修复后).pdf [ 683.89MB ]

| | | | | | | |—— book3-Credit Risk Measurement and Management(1).pdf [ 25.07MB ]

| | | | | | | |—— book2-Market Risk Measurement and Management.pdf [ 299.47MB ]

| | | | | | | |—— book1-Risk Management and Investment Management.pdf [ 315.61MB ]

| | | | | |—— 考试手册 [ 46.25MB ]

| | | | | | |—— 金融风险管理师考试手册.pdf [ 46.25MB ]

| | | | | |—— 考纲 [ 5.09MB ]

| | | | | | |—— 2020年FRM一二级考纲变化对比.pdf [ 4.23MB ]

| | | | | | |—— 2020年FRM考纲.pdf [ 887.97kB ]

| | | | | |—— 必考知识点 [ 434.75kB ]

| | | | | | |—— FRM必考知识点复习笔记.pdf [ 434.75kB ]

| | | | | |—— Handbook [ 48.40MB ]

| | | | | | |—— FRM Handbook(第六版).pdf [ 27.16MB ]

| | | | | | |—— FRM Handbook 第六版 中文版.pdf [ 13.98MB ]

| | | | | | |—— FRM Handbook 2021年.pdf [ 7.26MB ]

| | | | | |—— FRM一二级知识框架图 [ 189.94MB ]

| | | | | | |—— FRM一级知识框架图(更新) [ 14.28MB ]

| | | | | | | |—— 04 FRM一级知识框架图_金融市场与产品_金程教育(精读版).pdf [ 3.27MB ]

| | | | | | | |—— 03 FRM一级知识框架图_定量分析_金程教育(精读版).pdf [ 3.50MB ]

| | | | | | | |—— 02 FRM一级知识框架图_估值与风险模型_金程教育(精读版).pdf [ 3.44MB ]

| | | | | | | |—— 01 FRM一级知识框架图_风险管理基础_金程教育(精读版).pdf [ 4.06MB ]

| | | | | | |—— FRM二级知识框架图(更新) [ 175.67MB ]

| | | | | | | |—— 05 FRM二级知识框架图_巴塞尔协议_金程教育(精读版).pdf [ 33.91MB ]

| | | | | | | |—— 04 FRM二级知识框架图_信用风险管理_金程教育(精读版).pdf [ 35.72MB ]

| | | | | | | |—— 03 FRM二级知识框架图_投资组合管理_金程教育(精读版).pdf [ 36.00MB ]

| | | | | | | |—— 02 FRM二级知识框架图_市场风险管理_金程教育(精读版).pdf [ 34.92MB ]

| | | | | | | |—— 01 FRM二级知识框架图_操作风险管理_金程教育(精读版).pdf [ 35.12MB ]

| | | | | |—— FRM一二级易错题精编 [ 3.61MB ]

| | | | | | |—— FRM一级易错题精编(更新) [ 1.73MB ]

| | | | | | | |—— 04 FRM一级易错题精编_金融市场与产品_金程教育.pdf [ 376.30kB ]

| | | | | | | |—— 03_FRM一级易错题精编_定量分析_金程教育.pdf [ 314.65kB ]

| | | | | | | |—— 02 FRM一级易错题精编_估值和风险模型_金程教育.pdf [ 722.71kB ]

| | | | | | | |—— 01 FRM一级易错题精编_风险管理基础_金程教育.pdf [ 360.21kB ]

| | | | | | |—— FRM二级易错题精编(更新) [ 1.88MB ]

| | | | | | | |—— 05 FRM二级易错题精编_巴塞尔协议_金程教育.pdf [ 178.95kB ]

| | | | | | | |—— 04 FRM二级易错题精编_投资组合_金程教育.pdf [ 313.49kB ]

| | | | | | | |—— 03 FRM二级易错题精编_信用风险_金程教育.pdf [ 286.62kB ]

| | | | | | | |—— 02 FRM二级易错题精编_市场风险_金程教育.pdf [ 714.85kB ]

| | | | | | | |—— 01 FRM二级易错题精编_操作风险_金程教育.pdf [ 429.54kB ]

| | | | | |—— FRM一二级公式表 [ 2.43MB ]

| | | | | | |—— FRM一级备考公式表.pdf [ 1.20MB ]

| | | | | | |—— FRM二级备考公式表.pdf [ 1.23MB ]

| | | | | |—— FRM二级原版教材 [ 1.88GB ]

| | | | | | |—— book5-Liquidity and Treasury Risk Measurement and Management.pdf [ 602.56MB ]

| | | | | | |—— book4-Operational Risk and Resiliency.pdf [ 683.90MB ]

| | | | | | |—— book3-Credit Risk Measurement and Management(1).pdf [ 28.54MB ]

| | | | | | |—— book2-Market Risk Measurement and Management.pdf [ 299.27MB ]

| | | | | | |—— book1-Risk Management and Investment Management.pdf [ 315.42MB ]

| | | | |—— 22FRM二级原版教材 [ 1.66GB ]

| | | | | |—— 5. Risk Management and Investment Management.pdf [ 230.89MB ]

| | | | | |—— 4. Liquidity and Treasury Risk Measurement and Management.pdf [ 384.55MB ]

| | | | | |—— 3. Operational Risk and Resiliency.pdf [ 457.72MB ]

| | | | | |—— 2. Credit Risk Measurement and Management.pdf [ 432.94MB ]

| | | | | |—— 1. Market Risk Measurement and Management.pdf [ 198.76MB ]

| | | | |—— 22FRM二级notes [ 17.17MB ]

| | | | | |—— FRM 2022 Part II – SchweserNotes Book 5.pdf [ 3.48MB ]

| | | | | |—— FRM 2022 Part II – SchweserNotes Book 4.pdf [ 3.89MB ]

| | | | | |—— FRM 2022 Part II – SchweserNotes Book 3.pdf [ 3.41MB ]

| | | | | |—— FRM 2022 Part II – SchweserNotes Book 2.pdf [ 2.85MB ]

| | | | | |—— FRM 2022 Part II – SchweserNotes Book 1.pdf [ 2.12MB ]

| | | | | |—— FRM 2022 Part II – Schweser’s Quicksheet.pdf [ 1.43MB ]

| | | |—— 6.冲刺段 [ 4.75GB ]

| | | | |—— 2.FRM二级模考二 [ 2.37GB ]

| | | | | |—— 【课时4】模考二61-80.mp4 [ 563.05MB ]

| | | | | |—— 【课时3】模考二41-60.mp4 [ 461.21MB ]

| | | | | |—— 【课时2】模考二21-40.mp4 [ 580.28MB ]

| | | | | |—— 【课时1】模考二01-20.mp4 [ 815.17MB ]

| | | | | |—— 0.讲义 [ 2.35MB ]

| | | | | | |—— 2.FRM二级冲刺段模考二(答案)金程教育.pdf.pdf [ 931.45kB ]

| | | | | | |—— 1.FRM二级冲刺段模考二(题目)金程教育.pdf.pdf [ 1.44MB ]

| | | | |—— 1.FRM二级模考一 [ 2.38GB ]

| | | | | |—— 【课时4】41-60.mp4 [ 680.39MB ]

| | | | | |—— 【课时3】61-80.mp4 [ 519.37MB ]

| | | | | |—— 【课时2】21-40.mp4 [ 537.60MB ]

| | | | | |—— 【课时1】1-20.mp4 [ 698.39MB ]

| | | | | |—— 0.讲义 [ 2.04MB ]

| | | | | | |—— 2.FRM二级冲刺段模考一(答案)金程教育.pdf.pdf [ 912.84kB ]

| | | | | | |—— 1.FRM二级冲刺段模考一(题目)金程教育.pdf.pdf [ 1.15MB ]

| | | |—— 5.百题段 [ 13.34GB ]

| | | | |—— 5.操作风险测量与管理 [ 2.30GB ]

| | | | | |—— 【课时8】08 操作风险百题 71-94.mp4 [ 566.25MB ]

| | | | | |—— 【课时7】07 操作风险 61-70.mp4 [ 215.41MB ]

| | | | | |—— 【课时6】06 操作风险 51-60.mp4 [ 227.38MB ]

| | | | | |—— 【课时5】05 操作风险 41-50.mp4 [ 249.82MB ]

| | | | | |—— 【课时4】04 操作风险 31-40.mp4 [ 252.75MB ]

| | | | | |—— 【课时3】03 操作风险百题 21-30.mp4 [ 395.00MB ]

| | | | | |—— 【课时2】02 操作风险百题 11-20.mp4 [ 187.39MB ]

| | | | | |—— 【课时1】01 操作风险百题 01-10.mp4 [ 255.70MB ]

| | | | | |—— 0.讲义 [ 2.69MB ]

| | | | | | |—— 1.FRM二级百题段操作Mikey金程教育.pdf [ 2.69MB ]

| | | | |—— 4.流动性风险测量与管理 [ 933.09MB ]

| | | | | |—— 【课时7】百题61-Q71.mp4 [ 159.30MB ]

| | | | | |—— 【课时6】百题Q51-Q60.mp4 [ 84.19MB ]

| | | | | |—— 【课时5】百题Q41-Q50.mp4 [ 107.92MB ]

| | | | | |—— 【课时4】百题Q31-Q40.mp4 [ 128.04MB ]

| | | | | |—— 【课时3】百题Q21-Q30.mp4 [ 118.37MB ]

| | | | | |—— 【课时2】百题Q11-Q20.mp4 [ 166.54MB ]

| | | | | |—— 【课时1】百题Q1-Q10.mp4 [ 167.50MB ]

| | | | | |—— 0.讲义 [ 1.22MB ]

| | | | | | |—— 1.FRM二级百题流动性_Mikey_金程教育.pdf [ 1.22MB ]

| | | | |—— 3.风险管理与投资管理 [ 3.07GB ]

| | | | | |—— 【课时3】百题34-56.mp4 [ 1.17GB ]

| | | | | |—— 【课时2】百题17-33.mp4 [ 1.02GB ]

| | | | | |—— 【课时1】百题1-16.mp4 [ 905.49MB ]

| | | | | |—— 0.讲义 [ 1.92MB ]

| | | | | | |—— 1.FRM二级百题段投资管理_Cindy_金程教育.pdf [ 1.92MB ]

| | | | |—— 2.信用风险测量与管理 [ 4.09GB ]

| | | | | |—— 【课时4】FRM二级信用风险百题 79-116.mp4 [ 1.31GB ]

| | | | | |—— 【课时3】FRM二级信用风险百题 54-78.mp4 [ 947.91MB ]

| | | | | |—— 【课时2】FRM二级信用风险百题 27-53.mp4 [ 864.68MB ]

| | | | | |—— 【课时1】FRM二级信用风险百题 1-26.mp4 [ 1.01GB ]

| | | | | |—— 0.讲义 [ 3.53MB ]

| | | | | | |—— 1.RM二级百题段信用风险Lindsey(打印版).pdf [ 3.53MB ]

| | | | |—— 1.市场风险测量与管理 [ 2.97GB ]

| | | | | |—— 【课时4】百题Q58-Q86.mp4 [ 776.96MB ]

| | | | | |—— 【课时3】百题Q39-Q57.mp4 [ 736.43MB ]

| | | | | |—— 【课时2】百题Q12-Q38.mp4 [ 1.02GB ]

| | | | | |—— 【课时1】百题Q1-Q11.mp4 [ 475.82MB ]

| | | | | |—— 0.讲义 [ 1.12MB ]

| | | | | | |—— 1.FRM二级百题段市场风险Crystal金程教育.pdf [ 1.12MB ]

| | | |—— 4.经典题 [ 2.97GB ]

| | | | |—— 6.操作风险和弹性 [ 587.33MB ]

| | | | | |—— 【课时4】4.操作风险25-32.mp4 [ 86.05MB ]

| | | | | |—— 【课时3】3.操作风险经典题20-24.mp4 [ 48.24MB ]

| | | | | |—— 【课时2】2.操作风险经典题9-19.mp4 [ 290.80MB ]

| | | | | |—— 【课时1】1.操作风险经典题1-8.mp4 [ 161.45MB ]

| | | | | |—— 0.讲义 [ 809.69kB ]

| | | | | | |—— 1.FRM二级经典题操作风险_Mikey_金程教育.pdf [ 809.69kB ]

| | | | |—— 5.流动性和资金风险测量与管理 [ 601.45MB ]

| | | | | |—— 【课时1】1.流动性风险经典24题.mp4 [ 601.12MB ]

| | | | | |—— 0.讲义 [ 345.89kB ]

| | | | | | |—— 1.FRM二级经典题流动性_Alex_金程教育.pdf [ 345.89kB ]

| | | | |—— 4.案例 [ 123.13MB ]

| | | | | |—— 【课时1】1.案例经典题01-20.mp4 [ 123.13MB ]

| | | | |—— 3.风险管理和投资管理 [ 503.31MB ]

| | | | | |—— 【课时5】5.投资组合21-24.mp4 [ 83.15MB ]

| | | | | |—— 【课时4】4.投资组合16-20.mp4 [ 97.54MB ]

| | | | | |—— 【课时3】3.投资组合11-15.mp4 [ 91.33MB ]

| | | | | |—— 【课时2】2.投资组合6-10.mp4 [ 74.88MB ]

| | | | | |—— 【课时1】1.投资组合1-5.mp4 [ 156.12MB ]

| | | | | |—— 0.讲义 [ 294.62kB ]

| | | | | | |—— 1.FRM二级经典题风险管理和投资管理Wu金程教育.pdf [ 294.62kB ]

| | | | |—— 2.信用风险测量与管理 [ 735.27MB ]

| | | | | |—— 【课时1】1.经典题合并1-32.mp4 [ 734.96MB ]

| | | | | |—— 0.讲义 [ 317.98kB ]

| | | | | | |—— 1.FRM二级经典题信用风险测量与管理Yang金程教育.pdf [ 317.98kB ]

| | | | |—— 1.市场风险测量与管理 [ 493.11MB ]

| | | | | |—— 【课时2】2.市场风险经典题15-32.mp4 [ 268.55MB ]

| | | | | |—— 【课时1】1.市场风险经典题1-14.mp4 [ 224.20MB ]

| | | | | |—— 0.讲义 [ 363.61kB ]

| | | | | | |—— 1.FRM二级经典题市场风险测量与管理Gao金程教育.pdf [ 363.61kB ]

| | | |—— 3.强化段 [ 19.40GB ]

| | | | |—— 6.FRM二级知识图谱 [ 917.16MB ]

| | | | | |—— 【课时4】FRM二级名师带学知识图谱_操作风险与弹性.mp4 [ 281.22MB ]

| | | | | |—— 【课时3】FRM二级名师带学知识图谱_信用风险管理.mp4 [ 186.61MB ]

| | | | | |—— 【课时2】FRM二级名师带学知识图谱_流动性风险管理.mp4 [ 269.43MB ]

| | | | | |—— 【课时1】FRM二级名师带学_知识图谱_投资组合.mp4 [ 179.50MB ]

| | | | | |—— 0.讲义 [ 397.59kB ]

| | | | | | |—— 1.FRM二级知识图谱.zip.zip [ 397.59kB ]

| | | | |—— 5.操作风险测量与管理 [ 3.40GB ]

| | | | | |—— 【课时7】07 Part 5 Cyber-Resilient and Operational Resilience.mp4 [ 674.29MB ]

| | | | | |—— 【课时6】06 Part 4 The Basel Accord(2).mp4 [ 492.80MB ]

| | | | | |—— 【课时5】05 Part 4 The Basel Accord(1).mp4 [ 310.07MB ]

| | | | | |—— 【课时4】04 Part 3 Economic Capital Management and Other Related Issues.mp4 [ 607.65MB ]

| | | | | |—— 【课时3】03 Part 2 Model Risk and Data Quality.mp4 [ 565.28MB ]

| | | | | |—— 【课时2】02 Part 1 Operational Risk Management(2).mp4 [ 406.66MB ]

| | | | | |—— 【课时1】01 Part 1 Operational Risk Management(1).mp4 [ 425.40MB ]

| | | | | |—— 0.讲义 [ 2.48MB ]

| | | | | | |—— 2.FRM二级强化段操作Mikey金程教育(标准版).pdf [ 1.96MB ]

| | | | | | |—— 1.FRM二级强化段操作Mikey金程教育(打印版).pdf [ 526.69kB ]

| | | | |—— 4.流动性风险测量与管理 [ 1.62GB ]

| | | | | |—— 【课时5】5.Interest Risk and Liquidity Phenomenon.mp4 [ 209.17MB ]

| | | | | |—— 【课时4】4.Measure and Monitor Liquidity Risk.mp4 [ 178.54MB ]

| | | | | |—— 【课时3】3.Asset Management and Liability Management.mp4 [ 356.53MB ]

| | | | | |—— 【课时2】2.Manage Liquidity Risk.mp4 [ 386.35MB ]

| | | | | |—— 【课时1】1.Identify and Understand Liquidity.mp4 [ 527.22MB ]

| | | | | |—— 0.讲义 [ 4.00MB ]

| | | | | | |—— 2.FRM二级强化段流动性Mikey金程教育(打印版).pdf [ 1.10MB ]

| | | | | | |—— 1.FRM二级强化段流动性Mikey金程教育(标准版).pdf [ 2.90MB ]

| | | | |—— 3.风险管理与投资管理 [ 3.72GB ]

| | | | | |—— 【课时4】4.对冲基金.mp4 [ 884.59MB ]

| | | | | |—— 【课时3】3.风险管理.mp4 [ 1,021.13MB ]

| | | | | |—— 【课时2】2.组合构建.mp4 [ 831.66MB ]

| | | | | |—— 【课时1】1.因子理论.mp4 [ 1.05GB ]

| | | | | |—— 0.讲义 [ 2.01MB ]

| | | | | | |—— 2.FRM二级强化段投资Cindy金程教育(打印版).pdf [ 484.33kB ]

| | | | | | |—— 1.FRM二级强化段投资Cindy金程教育(标准版).pdf [ 1.53MB ]

| | | | |—— 2.信用风险测量与管理 [ 4.52GB ]

| | | | | |—— 【课时4】4.信用衍生品、证券化及零售信贷风险分析.mp4 [ 1.32GB ]

| | | | | |—— 【课时3】3.信用风险缓释工具.mp4 [ 1.36GB ]

| | | | | |—— 【课时2】2.违约概率计量模型.mp4 [ 906.08MB ]

| | | | | |—— 【课时1】1.信用风险识别、评级系统及违约概率运用.mp4 [ 967.67MB ]

| | | | | |—— 0.讲义 [ 2.72MB ]

| | | | | | |—— 2.FRM二级强化段信用风险Lindsey(打印版).pdf [ 711.97kB ]

| | | | | | |—— 1.FRM二级强化段信用风险Lindsey(标准版).pdf [ 2.03MB ]

| | | | |—— 1.市场风险测量与管理 [ 5.24GB ]

| | | | | |—— 【课时9】9.Volatility Smiles.mp4 [ 279.20MB ]

| | | | | |—— 【课时8】8.Term Structure Models of Interest Rates.mp4 [ 1.01GB ]

| | | | | |—— 【课时7】7.Empirical Approaches to Risk Metrics and Hedges.mp4 [ 124.07MB ]

| | | | | |—— 【课时6】6.Modeling Dependence Correlations And Copulas.mp4 [ 598.66MB ]

| | | | | |—— 【课时5】5.Risk Measurement for the Trading Book.mp4 [ 314.26MB ]

| | | | | |—— 【课时4】4.VaR Mapping.mp4 [ 755.52MB ]

| | | | | |—— 【课时3】3.Backtesting VaR.mp4 [ 721.96MB ]

| | | | | |—— 【课时2】2.Extreme value.mp4 [ 245.11MB ]

| | | | | |—— 【课时1】1.Estimating Market Risk Measures.mp4 [ 1.26GB ]

| | | | | |—— 0.讲义 [ 2.53MB ]

| | | | | | |—— 2.FRM二级强化市场Crystal金程教育(电子版).pdf [ 1.78MB ]

| | | | | | |—— 1.FRM二级强化市场Crystal金程教育(打印版).pdf [ 769.57kB ]

| | | |—— 2.基础段 [ 76.29GB ]

| | | | |—— 6.Current Issues [ 4.51GB ]

| | | | | |—— 【课时8】The Rise of digital money.mp4 [ 422.36MB ]

| | | | | |—— 【课时7】Climate-related risk drivers and their transmission channels.mp4 [ 914.82MB ]

| | | | | |—— 【课时6】AI Risk & Governance.mp4 [ 372.38MB ]

| | | | | |—— 【课时5】ML and AI for Risk Management.mp4 [ 480.06MB ]

| | | | | |—— 【课时4】LIBOR transition Case studies for navigating conduct risks.mp4 [ 944.64MB ]

| | | | | |—— 【课时3】Beyond LIBOR- a primer on the new benchmark rates.mp4 [ 516.09MB ]

| | | | | |—— 【课时2】Holistic Review of the March Market Turmoil.mp4 [ 693.50MB ]

| | | | | |—— 【课时1】Covid-19 and cyber risk in the financial sector.mp4 [ 278.83MB ]

| | | | |—— 5.Liquidity and Treasury Risk Measurement and Management [ 19.31GB ]

| | | | | |—— 【课时9】9.Liquidity Stress Testing.mp4 [ 334.82MB ]

| | | | | |—— 【课时8】8.The Failure Mechanics of Dealer Banks.mp4 [ 235.48MB ]

| | | | | |—— 【课时7】7.Monitoring Liquidity.mp4 [ 1.17GB ]

| | | | | |—— 【课时6】6.Intraday Liquidity Risk Management.mp4 [ 311.61MB ]

| | | | | |—— 【课时5】5.Liquidity and Reserves Management Strategies and Policies.mp4 [ 787.60MB ]

| | | | | |—— 【课时4】4.The Investment Function in Financial-Services Management.mp4 [ 890.09MB ]

| | | | | |—— 【课时3】3.Early Warning Indicators.mp4 [ 135.78MB ]

| | | | | |—— 【课时2】2.Liquidity and Leverage.mp4 [ 378.99MB ]

| | | | | |—— 【课时1】1.Liquidity Risk.mp4 [ 1.10GB ]

| | | | | |—— 【课时19】19.Illiquid Assets.mp4 [ 264.66MB ]

| | | | | |—— 【课时18】18.Risk Management for Changing Interest Rates Asset-Liability Management and D.mp4 [ 488.23MB ]

| | | | | |—— 【课时17】17.Interest Parity Lost Understanding the Cross-Currency Basis.mp4 [ 170.67MB ]

| | | | | |—— 【课时16】16.The US Dollar Shortage in Global Banking and the International Policy Respons.mp4 [ 106.99MB ]

| | | | | |—— 【课时15】15.Liquidity Transfer Pricing A Guide to Better Practice.mp4 [ 285.97MB ]

| | | | | |—— 【课时14】14.Repurchase Agreements and Financing.mp4 [ 382.72MB ]

| | | | | |—— 【课时13】13.Managing Nondeposit Liabilities.mp4 [ 458.00MB ]

| | | | | |—— 【课时12】12.Managing and Pricing Deposit Services.mp4 [ 440.95MB ]

| | | | | |—— 【课时11】11.Contingency Funding Planning.mp4 [ 276.61MB ]

| | | | | |—— 【课时10】10.Liquidity Risk Reporting and Stress Testing.mp4 [ 26.36MB ]

| | | | | |—— Mikey Chow [ 11.20GB ]

| | | | | | |—— 【课时9】9.Liquidity Stress Testing.mp4 [ 306.93MB ]

| | | | | | |—— 【课时8】8.The Failure Mechanics of Dealer Banks.mp4 [ 161.39MB ]

| | | | | | |—— 【课时7】7.Monitoring Liquidity.mp4 [ 1.03GB ]

| | | | | | |—— 【课时6】6.Intraday Liquidity Risk Management.mp4 [ 501.41MB ]

| | | | | | |—— 【课时5】5.Liquidity and Reserves Management Strategies and Policies.mp4 [ 1,015.68MB ]

| | | | | | |—— 【课时4】4.The Investment Function in Financial-Services Management.mp4 [ 732.76MB ]

| | | | | | |—— 【课时3】3.Early Warning Indicators.mp4 [ 82.53MB ]

| | | | | | |—— 【课时2】2.Liquidity and Leverage.mp4 [ 1.08GB ]

| | | | | | |—— 【课时1】1.Liquidity Risk.mp4 [ 1.20GB ]

| | | | | | |—— 【课时1】1.Liquidity Risk-1643449020.mp4 [ 1.20GB ]

| | | | | | |—— 【课时19】19.Illiquid Assets.mp4 [ 603.96MB ]

| | | | | | |—— 【课时18】18.Risk Management for Changing Interest Rates Asset-Liability Management and D.mp4 [ 708.79MB ]

| | | | | | |—— 【课时17】17.Interest Parity Lost Understanding the Cross-Currency Basis.mp4 [ 248.85MB ]

| | | | | | |—— 【课时16】16.The US Dollar Shortage in Global Banking and the International Policy Respons.mp4 [ 145.36MB ]

| | | | | | |—— 【课时15】15.Liquidity Transfer Pricing A Guide to Better Practice.mp4 [ 390.81MB ]

| | | | | | |—— 【课时14】14.Repurchase Agreements and Financing.mp4 [ 465.18MB ]

| | | | | | |—— 【课时13】13.Managing Nondeposit Liabilities.mp4 [ 562.67MB ]

| | | | | | |—— 【课时12】12.Managing and Pricing Deposit Services.mp4 [ 589.65MB ]

| | | | | | |—— 【课时11】11.Contingency Funding Planning.mp4 [ 185.18MB ]

| | | | | | |—— 【课时10】10.Liquidity Risk Reporting and Stress Testing.mp4 [ 149.57MB ]

| | | | |—— 4.Operational Risk and Resiliency [ 15.64GB ]

| | | | | |—— Galina Liang [ 8.03GB ]

| | | | | | |—— 【课时8】8. Cyber-Resilient and Operational Resilience.mp4 [ 1.46GB ]

| | | | | | |—— 【课时7】7. Basel III Reforms and Finalization and Other Regulations.mp4 [ 854.66MB ]

| | | | | | |—— 【课时6】6. Capital Regulation Before the Global Financial Crisis.mp4 [ 762.34MB ]

| | | | | | |—— 【课时5】5. Economic Capital and Other Related Issues.mp4 [ 1.02GB ]

| | | | | | |—— 【课时4】4. Validating Models and RAROC.mp4 [ 1.01GB ]

| | | | | | |—— 【课时3】3. Operational Risk Data and Model Risk Management.mp4 [ 1.05GB ]

| | | | | | |—— 【课时2】2.Enterprise Risk Management and RAF.mp4 [ 947.73MB ]

| | | | | | |—— 【课时1】1. Revisions to the Principles for the Sound Management of Operational Risk.mp4 [ 1,000.61MB ]

| | | | | |—— Alex Yao [ 7.61GB ]

| | | | | | |—— 【课时8】8. Cyber-Resilient and Operational Resilience.mp4 [ 951.37MB ]

| | | | | | |—— 【课时7】7. Basel III Reforms and Finalization and Other Regulations.mp4 [ 621.92MB ]

| | | | | | |—— 【课时6】6. Capital Regulation Before the Global Financial Crisis.mp4 [ 1.28GB ]

| | | | | | |—— 【课时5】5. Economic Capital and Other Related Issues.mp4 [ 611.93MB ]

| | | | | | |—— 【课时4】4. Validating Models and RAROC.mp4 [ 846.17MB ]

| | | | | | |—— 【课时3】3. Operational Risk Data and Model Risk Management.mp4 [ 1.42GB ]

| | | | | | |—— 【课时2】2.Enterprise Risk Management and RAF.mp4 [ 1.09GB ]

| | | | | | |—— 【课时1】1. Revisions to the Principles for the Sound Management of Operational Risk.mp4 [ 886.47MB ]

| | | | |—— 3.Risk Management and Investment Management [ 15.59GB ]

| | | | | |—— Crystal Gao [ 7.95GB ]

| | | | | | |—— 【课时9】9.Performance Measurement 2.mp4 [ 815.75MB ]

| | | | | | |—— 【课时8】8.Performance Measurement 1.mp4 [ 1.43GB ]

| | | | | | |—— 【课时7】7.Portfolio Risk Management 2.mp4 [ 702.39MB ]

| | | | | | |—— 【课时6】6.Portfolio Risk Management 1.mp4 [ 630.37MB ]

| | | | | | |—— 【课时5】5.Portfolio VaR.mp4 [ 590.88MB ]

| | | | | | |—— 【课时4】4.Portfolio Construction.mp4 [ 776.44MB ]

| | | | | | |—— 【课时3】3.Alpha.mp4 [ 809.37MB ]

| | | | | | |—— 【课时2】2.Factors.mp4 [ 614.22MB ]

| | | | | | |—— 【课时1】1.Factor Theory.mp4 [ 666.89MB ]

| | | | | | |—— 【课时10】10.Hedge Fund.mp4 [ 1.04GB ]

| | | | | |—— Cindy Wu [ 7.64GB ]

| | | | | | |—— 【课时9】9.Performance Measurement 2.mp4 [ 515.77MB ]

| | | | | | |—— 【课时8】8.Performance Measurement 1.mp4 [ 429.24MB ]

| | | | | | |—— 【课时7】7.Portfolio Risk Management 2.mp4 [ 976.43MB ]

| | | | | | |—— 【课时6】6.Portfolio Risk Management 1.mp4 [ 888.65MB ]

| | | | | | |—— 【课时5】5.Portfolio VaR.mp4 [ 1.56GB ]

| | | | | | |—— 【课时4】4.Portfolio Construction.mp4 [ 601.84MB ]

| | | | | | |—— 【课时3】3.Alpha.mp4 [ 563.29MB ]

| | | | | | |—— 【课时2】2.Factors.mp4 [ 484.08MB ]

| | | | | | |—— 【课时1】1.Factor Theory.mp4 [ 666.89MB ]

| | | | | | |—— 【课时10】10.Hedge Fund.mp4 [ 1.08GB ]

| | | | |—— 2.Market Risk Measurement and Management [ 10.32GB ]

| | | | | |—— Mikey Chow [ 10.32GB ]

| | | | | | |—— 【课时9】9.Financial Correlation Modeling.mp4 [ 440.18MB ]

| | | | | | |—— 【课时8】8.Empirical Properties of Correlation.mp4 [ 377.48MB ]

| | | | | | |—— 【课时7】7.Some Correlation Basics.mp4 [ 752.81MB ]

| | | | | | |—— 【课时6】6.Risk Measurement for the Trading Book.mp4 [ 1.05GB ]

| | | | | | |—— 【课时5】5.VaR Mapping.mp4 [ 1.07GB ]

| | | | | | |—— 【课时4】4.Backtesting VaR.mp4 [ 1.15GB ]

| | | | | | |—— 【课时3】3.Extreme value.mp4 [ 554.85MB ]

| | | | | | |—— 【课时2】2.Non-parametric Approaches.mp4 [ 1.60GB ]

| | | | | | |—— 【课时1】1.Parametric Approaches.mp4 [ 730.94MB ]

| | | | | | |—— 【课时14】14.Volatility Smiles.mp4 [ 534.34MB ]

| | | | | | |—— 【课时13】13.The Art of Term Structure Models Drift & Volatility and Distribution.mp4 [ 765.16MB ]

| | | | | | |—— 【课时12】12.The Evolution of Short Rates and the Shape of the Term Structure.mp4 [ 290.79MB ]

| | | | | | |—— 【课时11】11.The Science of Term Structure Models.mp4 [ 679.89MB ]

| | | | | | |—— 【课时10】10.Empirical Approaches to Risk Metrics and Hedges.mp4 [ 451.43MB ]

| | | | | |—— 0.讲义 [ 5.04MB ]

| | | | | | |—— 6.FRM二级基础段市场风险Mikey(打印版).pdf [ 1.33MB ]

| | | | | | |—— 5.FRM二级基础段市场风险Mikey(标准版).pdf [ 3.70MB ]

| | | | |—— 1.Credit Risk Measurement and Management [ 10.84GB ]

| | | | | |—— Mikey Chow [ 10.84GB ]

| | | | | | |—— 【课时9】9.Credit Derivatives.mp4 [ 515.98MB ]

| | | | | | |—— 【课时8】8.Mitigation of Counterparty Risk.mp4 [ 1.43GB ]

| | | | | | |—— 【课时7】7.Counterparty Risk 2.mp4 [ 790.44MB ]

| | | | | | |—— 【课时6】6.Counterparty Risk 1.mp4 [ 1.17GB ]

| | | | | | |—— 【课时5】5.Credit Exposure.mp4 [ 603.68MB ]

| | | | | | |—— 【课时4】4.Probability of Default 2.mp4 [ 1.43GB ]

| | | | | | |—— 【课时3】3.Probability of Default 1.mp4 [ 578.48MB ]

| | | | | | |—— 【课时2】2.Introduction of Credit Risk 2.mp4 [ 1.20GB ]

| | | | | | |—— 【课时1】1.Introduction of Credit Risk 1.mp4 [ 476.97MB ]

| | | | | | |—— 【课时12】12.Retail Credit Risk Management.mp4 [ 599.30MB ]

| | | | | | |—— 【课时11】11.Securitization 2.mp4 [ 1.16GB ]

| | | | | | |—— 【课时10】10.Securitization 1.mp4 [ 985.14MB ]

| | | | | |—— 0.讲义 [ 88B ]

| | | | | | |—— 6.FRM二级基础段信用Mikey金程教育(打印版).pdf [ 44B ]

| | | | | | |—— 5.FRM二级基础段信用Mikey金程教育(标准版).pdf [ 44B ]

| | | | |—— 0.讲义 [ 73.02MB ]

| | | | | |—— FRM二级基础段金融热点话题(三).pdf [ 2.16MB ]

| | | | | |—— 9.FRM二级基础段操作Glina金程教育(打印版).pdf [ 793.30kB ]

| | | | | |—— 8.FRM二级基础段操作Glina金程教育(标准版).pdf [ 2.18MB ]

| | | | | |—— 7.FRM二级市场风险知识框架Crystal(打印版).pdf [ 295.13kB ]

| | | | | |—— 7.FRM二级市场风险知识框架Crystal.pdf [ 1.60MB ]

| | | | | |—— 6.FRM二级信用知识框架_Lindsey(标准版).pdf [ 560.19kB ]

| | | | | |—— 6.FRM二级基础段流动性Mikey金程教育(标准版).pdf [ 4.09MB ]

| | | | | |—— 5.FRM二级信用知识框架_Lindsey(打印版).pdf [ 252.95kB ]

| | | | | |—— 5.FRM二级操作知识框架Mikey金程教育(打印版).pdf [ 225.26kB ]

| | | | | |—— 4.FRM二级基础段市场风险Crystal(打印版).pdf [ 1.05MB ]

| | | | | |—— 4.FRM二级基础段金融热点话题(二)(打印版).pdf [ 286.30kB ]

| | | | | |—— 4.FRM二级操作知识框架Mikey金程教育(标准版).pdf [ 599.42kB ]

| | | | | |—— 3.FRM二级基础段市场风险Crystal(标准版).pdf [ 6.47MB ]

| | | | | |—— 3.FRM二级基础段流动性Mikey金程教育(打印版).pdf [ 1.76MB ]

| | | | | |—— 3.FRM二级基础段金融热点话题(二)(电子版).pdf [ 481.50kB ]

| | | | | |—— 24.FRM二级基础段操作Glina金程教育(打印版).pdf [ 817.95kB ]

| | | | | |—— 23.FRM二级基础段操作Glina金程教育(标准版).pdf [ 2.18MB ]

| | | | | |—— 22.FRM二级基础段投资Cindy金程教育(打印版).pdf [ 694.18kB ]

| | | | | |—— 21.FRM二级基础段投资Cindy金程教育(标准版).pdf [ 1.37MB ]

| | | | | |—— 20.FRM二级基础段市场风险Crystal(打印版).pdf [ 1.26MB ]

| | | | | |—— 2.FRM二级投资知识框架_Cindy(打印版).pdf [ 275.02kB ]

| | | | | |—— 2.FRM二级基础段信用风险_Lindsey_金程教育.pdf [ 1.58MB ]

| | | | | |—— 19.FRM二级市场风险知识框架Crystal.pdf [ 1.32MB ]

| | | | | |—— 19.FRM二级市场风险知识框架Crystal(1).pdf [ 1.32MB ]

| | | | | |—— 18.FRM二级基础段市场风险Crystal(标准版).pdf [ 6.47MB ]

| | | | | |—— 18.FRM二级基础段市场风险Crystal(标准版)(1).pdf [ 7.09MB ]

| | | | | |—— 17.FRM二级信用知识框架_Lindsey(标准版).pdf [ 560.19kB ]

| | | | | |—— 17.FRM二级信用知识框架_Lindsey(标准版)(1).pdf [ 560.19kB ]

| | | | | |—— 17.FRM二级基础段金融热点_金程教育(电子版).pdf [ 2.97MB ]

| | | | | |—— 16.FRM二级信用知识框架_Lindsey(打印版).pdf [ 252.96kB ]

| | | | | |—— 16.FRM二级信用知识框架_Lindsey(打印版)(1).pdf [ 238.56kB ]

| | | | | |—— 16.FRM二级基础段金融热点_金程教育(打印版).pdf [ 821.84kB ]

| | | | | |—— 15.FRM二级基础段信用风险_Lindsey_金程教育.pdf [ 1.58MB ]

| | | | | |—— 14.FRM二级基础段投资Cindy金程教育(打印版).pdf [ 694.18kB ]

| | | | | |—— 13.FRM二级基础段投资Cindy金程教育(标准版).pdf [ 1.37MB ]

| | | | | |—— 13.FRM二级基础段操作Alex金程教育(打印版).pdf [ 887.67kB ]

| | | | | |—— 12.FRM二级基础段投资管理_Crystal_金程教育.zip [ 2.51MB ]

| | | | | |—— 12.FRM二级基础段操作Alex金程教育(标准版).pdf [ 3.49MB ]

| | | | | |—— 11.FRM二级投资知识框架_Cindy(打印版).pdf [ 275.02kB ]

| | | | | |—— 11.FRM二级基础流动性_Alex_金程(打印版).pdf [ 2.22MB ]

| | | | | |—— 10.FRM二级投资知识框架_Cindy(标准版).pdf [ 618.39kB ]

| | | | | |—— 10.FRM二级基础流动性_Alex_金程(标准版).pdf [ 3.61MB ]

| | | | | |—— 1.FRM二级投资知识框架_Cindy(标准版).pdf [ 508.90kB ]

| | | | | |—— 1.FRM二级基础段信用风险_Lindsey_金程教育.pdf [ 2.95MB ]

| | | |—— 1.前导段 [ 2.52GB ]

| | | | |—— 1.框架介绍 [ 2.52GB ]

| | | | | |—— 【课时4】FRM二级前导-流动性风险与投资组合管理.mp4 [ 686.06MB ]

| | | | | |—— 【课时3】FRM二级前导-操作风险.mp4 [ 733.16MB ]

| | | | | |—— 【课时2】FRM二级前导-信用风险.mp4 [ 396.40MB ]

| | | | | |—— 【课时1】FRM二级前导-市场风险.mp4 [ 767.79MB ]

| | | | |—— 0.讲义 [ 1.47MB ]

| | | | | |—— 1.FRM二级前导段框架介绍_Crystal_金程教育.zip [ 1.47MB ]

| | | |—— 07-知识图谱 [ 5.06GB ]

| | | | |—— 【名师带学】信用风险 [ 256.34MB ]

| | | | | |—— 【F2 金 串讲框架】3.信用风险科目串讲-Lindsey.mp4 [ 256.34MB ]

| | | | |—— 【名师带学】投资管理 [ 1.75GB ]

| | | | | |—— 【课时1】FRM二级名师带学-投资-吴帆-FRM二级基础段科目串讲风险管理和投资管理-Cindy.mp4 [ 1.75GB ]

| | | | |—— 【名师带学】投市场风险 [ 222.59MB ]

| | | | | |—— 【F2 金 串讲框架】2.市场风险科目串讲-Crystal.mp4 [ 222.59MB ]

| | | | |—— 【名师带学】流动性风险 [ 1.11GB ]

| | | | | |—— 【课时1】FRM二级名师带学-流动性风险-姚奕-流动性风险.mp4 [ 1.11GB ]

| | | | | |—— 2.FRM二级流动性知识框架Alex(打印版).pdf [ 597.56kB ]

| | | | | |—— 1.FRM二级流动性知识框架Alex(标准版).pdf [ 1.03MB ]

| | | | |—— 【名师带学】操作风险 [ 1.73GB ]

| | | | | |—— 【课时1】FRM二级名师带学-周琪-操作风险.mp4 [ 1.73GB ]

| | | | |—— 0.讲义 [ 397.59kB ]

| | | | | |—— 1.FRM二级知识图谱.zip.zip [ 397.59kB ]

| | |—— FRM二级高顿2022 [ 36.58GB ]

| | | |—— 【7】模考班 [ 2.27GB ]

| | | | |—— 流动性风险 Mock B 答疑讲义.pdf [ 380.66kB ]

| | | | |—— 操作风险 Mock Exam B 答疑直播.mp4 [ 336.08MB ]

| | | | |—— 操作风险 Mock Exam B 答疑讲义.pdf [ 7.33MB ]

| | | | |—— Mock Exam B 信用风险答疑直播.mp4 [ 181.77MB ]

| | | | |—— Mock Exam B 市场风险答疑直播.mp4 [ 151.56MB ]

| | | | |—— Mock Exam B – 流动性风险 答疑直播.mp4 [ 339.00MB ]

| | | | |—— Mock Exam B – 风险管理与投资管理 答疑直播.mp4 [ 152.77MB ]

| | | | |—— Mock Exam B – 风险管理与投资管理 答疑讲义.pdf [ 7.72MB ]

| | | | |—— Mock B 信用风险答疑(讲义).pdf [ 7.30MB ]

| | | | |—— Mock B 市场风险答疑(讲义).pdf [ 7.57MB ]

| | | | |—— A [ 1.11GB ]

| | | | | |—— 市场风险- Mock Exam A 答疑直播.mp4 [ 377.27MB ]

| | | | | |—— 流动性风险 Mock Exam A 答疑直播.mp4 [ 201.40MB ]

| | | | | |—— 流动性风险 Mock A 答疑(讲义).pdf [ 425.86kB ]

| | | | | |—— 操作风险 Mock A 答疑直播.mp4 [ 201.73MB ]

| | | | | |—— 操作风险 Mock A 答疑讲义.pdf [ 8.91MB ]

| | | | | |—— Mock Exam A- 风险管理与投资管理(讲义).pdf [ 7.27MB ]

| | | | | |—— Mock Exam A 信用风险答疑直播.mp4 [ 186.69MB ]

| | | | | |—— Mock Exam A – 风险管理和投资管理 答疑直播.mp4 [ 144.99MB ]

| | | | | |—— Mock A 信用风险答疑(讲义).pdf [ 489.41kB ]

| | | | | |—— Mock A 市场风险答疑(讲义).pdf [ 7.33MB ]

| | | |—— 【6】强化题解析 [ 714.52MB ]

| | | | |—— 信用风险 [ 213.06MB ]

| | | | | |—— 信用风险强化题解析4.mp4 [ 58.51MB ]

| | | | | |—— 信用风险强化题解析3.mp4 [ 50.97MB ]

| | | | | |—— 信用风险强化题解析2.mp4 [ 41.10MB ]

| | | | | |—— 信用风险强化题解析1.mp4 [ 62.48MB ]

| | | | |—— 市场风险 [ 205.93MB ]

| | | | | |—— 市场风险强化题解析5.mp4 [ 29.92MB ]

| | | | | |—— 市场风险强化题解析4.mp4 [ 35.00MB ]

| | | | | |—— 市场风险强化题解析3.mp4 [ 53.64MB ]

| | | | | |—— 市场风险强化题解析2.mp4 [ 43.70MB ]

| | | | | |—— 市场风险强化题解析1.mp4 [ 43.67MB ]

| | | | |—— 风险管理和投资管理 [ 295.53MB ]

| | | | | |—— 风险管理和投资管理31-43.mp4 [ 66.56MB ]

| | | | | |—— 风险管理和投资管理16-30.mp4 [ 114.12MB ]

| | | | | |—— 风险管理和投资管理1-15.mp4 [ 114.85MB ]

| | | |—— 【5】重难点直播 [ 1.02GB ]

| | | | |—— 信用风险—重难点答疑直播.mp4 [ 188.86MB ]

| | | | |—— 信用风险 重难点答疑(讲义).pdf [ 10.55MB ]

| | | | |—— 市场风险—重难点答疑直播.mp4 [ 177.73MB ]

| | | | |—— 市场风险-重难点答疑直播(讲义).pdf [ 5.10MB ]

| | | | |—— 流动性风险-复习强化题答疑(讲义).pdf [ 9.82MB ]

| | | | |—— 流动性风险 强化题答疑直播.mp4 [ 206.28MB ]

| | | | |—— 风险管理与投资管理 强化题答疑直播.mp4 [ 204.36MB ]

| | | | |—— 风险管理与投资管理 强化题答疑(讲义).pdf [ 9.12MB ]

| | | | |—— 操作与综合风险 强化题答疑直播.mp4 [ 218.52MB ]

| | | | |—— 操作与综合风险 强化题答疑讲义.pdf [ 11.79MB ]

| | | | |—— P2B1和P2B5百题集训题目对比(补充讲义).pdf [ 1.29MB ]

| | | |—— 【4】百题集训 [ 2.70GB ]

| | | | |—— 信用风险测量与管理答疑直播.mp4 [ 847.30MB ]

| | | | |—— 信用风险测量与管理-答疑直播(讲义).pdf [ 12.76MB ]

| | | | |—— 市场风险测量与管理-答疑直播.mp4 [ 241.29MB ]

| | | | |—— 市场风险测量与管理-答疑直播(讲义).pdf [ 4.58MB ]

| | | | |—— 市场风险测量与管理-答疑直播(带解析版本补充讲义).pdf [ 4.90MB ]

| | | | |—— 流动性风险-答疑直播.mp4 [ 623.55MB ]

| | | | |—— 流动性风险-答疑直播(讲义).pdf [ 589.71kB ]

| | | | |—— 流动性风险-答疑直播(补充讲义).pdf [ 1.22MB ]

| | | | |—— 风险管理与投资管理-答疑直播.mp4 [ 198.35MB ]

| | | | |—— 风险管理与投资管理-答疑直播(讲义).pdf [ 9.09MB ]

| | | | |—— 操作风险与综合风险-答疑直播.mp4 [ 800.92MB ]

| | | | |—— 操作风险和综合风险-答疑直播(讲义).pdf [ 9.51MB ]

| | | | |—— 操作风险和综合风险-答疑直播(辅助知识点).pdf [ 6.86MB ]

| | | |—— 【3】复习阶段 [ 4.46GB ]

| | | | |—— FRM P2信用-复习串讲(Gloria).pdf [ 34.43MB ]

| | | | |—— FRM P2投资风险-复习串讲(Gloria).pdf [ 26.03MB ]

| | | | |—— FRM P2流动性风险-复习串讲(GONG).pdf [ 79.94MB ]

| | | | |—— FRM P2B3 操作风险 复习串讲(Leo) .pdf [ 38.63MB ]

| | | | |—— 05-操作与综合风险-复习串讲 [ 1.11GB ]

| | | | | |—— 21-Operational Resilience and Impact Tolerance.mp4 [ 13.79MB ]

| | | | | |—— 20-Cyber Risk and Cyber Resilience.mp4 [ 42.45MB ]

| | | | | |—— 19-Outsourcing risk, ML and FT.mp4 [ 16.48MB ]

| | | | | |—— 18-Basel Accords-FRTB.mp4 [ 75.08MB ]

| | | | | |—— 17-Basel Accords-Basel III Reform.mp4 [ 93.01MB ]

| | | | | |—— 16-Basel Accords-Basel III.mp4 [ 128.50MB ]

| | | | | |—— 15-Basel Accords-Basel II.5.mp4 [ 42.70MB ]

| | | | | |—— 14-Basel Accords-Basel II.mp4 [ 137.89MB ]

| | | | | |—— 13-Basel Accords-Basel I Amendments.mp4 [ 55.65MB ]

| | | | | |—— 12-Basel Accords-Basel I.mp4 [ 38.25MB ]

| | | | | |—— 11-Basel Accords-Regulation of the OTC Derivative Market.mp4 [ 44.89MB ]

| | | | | |—— 10-Stress Testing Banks.mp4 [ 22.38MB ]

| | | | | |—— 09-Risk Capital Attribution & Risk-Adjusted Performance.mp4 [ 51.70MB ]

| | | | | |—— 08-Models.mp4 [ 46.08MB ]

| | | | | |—— 07-Information Risk and Data Quality Management.mp4 [ 17.44MB ]

| | | | | |—— 06-OpRisk Data and Governance.mp4 [ 49.61MB ]

| | | | | |—— 05-Risk management Framework(4).mp4 [ 34.38MB ]

| | | | | |—— 04-Risk management Framework(3).mp4 [ 56.33MB ]

| | | | | |—— 03-Risk management Framework(2).mp4 [ 47.17MB ]

| | | | | |—— 02-Risk management Framework(1).mp4 [ 107.05MB ]

| | | | | |—— 01-Introduction.mp4 [ 14.98MB ]

| | | | |—— 04-投资管理与风险管理 [ 710.57MB ]

| | | | | |—— 11-Performing Due diligence on Specific Managers and Funds.mp4 [ 13.24MB ]

| | | | | |—— 10-Hedge Funds.mp4 [ 83.76MB ]

| | | | | |—— 09-Portfolio Performance Evaluation.mp4 [ 81.48MB ]

| | | | | |—— 08-VaR and Risk Budgeting in Investment Management.mp4 [ 17.56MB ]

| | | | | |—— 07-VaR and Risk Budgeting in Investment Management.mp4 [ 78.69MB ]

| | | | | |—— 06-Portfolio Risk :Analytical Methods.mp4 [ 92.42MB ]

| | | | | |—— 05-Portfolio Construction.mp4 [ 101.77MB ]

| | | | | |—— 04-Alpha (and the Low-Risk Anomaly).mp4 [ 94.89MB ]

| | | | | |—— 03-Factors.mp4 [ 42.34MB ]

| | | | | |—— 02-Factor Theory.mp4 [ 76.88MB ]

| | | | | |—— 01-课程介绍.mp4 [ 27.54MB ]

| | | | |—— 03-流动性风险 [ 601.24MB ]

| | | | | |—— 20-Contingency funding planning.mp4 [ 18.81MB ]

| | | | | |—— 19-Early warning indicators.mp4 [ 16.89MB ]

| | | | | |—— 18-Monitoring liquidity.mp4 [ 22.40MB ]

| | | | | |—— 17-Intraday liquidity risk management.mp4 [ 21.36MB ]

| | | | | |—— 16-Liquidity risk reporting and stress testing.mp4 [ 23.30MB ]

| | | | | |—— 15-Liquidity stress testing.mp4 [ 34.53MB ]

| | | | | |—— 14-Risk management for changing interest rate.mp4 [ 50.23MB ]

| | | | | |—— 13-Managing nondeposit liabilities.mp4 [ 25.79MB ]

| | | | | |—— 12-Managing and pricing deposit services.mp4 [ 29.40MB ]

| | | | | |—— 11-Liquidity and reserves management.mp4 [ 49.11MB ]

| | | | | |—— 10-llliquid assets.mp4 [ 42.29MB ]

| | | | | |—— 09-Repurchase agreements and financing.mp4 [ 44.05MB ]

| | | | | |—— 08-The investment function in financial-services management.mp4 [ 46.44MB ]

| | | | | |—— 07-The US dollar shortage in global banking.mp4 [ 12.47MB ]

| | | | | |—— 06-Covered interest rate parity lost.mp4 [ 32.69MB ]

| | | | | |—— 05-The failure of dealer banks.mp4 [ 13.15MB ]

| | | | | |—— 04-Liquidity transfer pricing.mp4 [ 32.16MB ]

| | | | | |—— 03-Liquidity and leverge.mp4 [ 38.56MB ]

| | | | | |—— 02-Liquidity risk.mp4 [ 36.01MB ]

| | | | | |—— 01-Introduction.mp4 [ 11.62MB ]

| | | | |—— 02-信用风险测量与管理 [ 1.09GB ]

| | | | | |—— 20-Frictions of securitization.mp4 [ 25.45MB ]

| | | | | |—— 19-Securitization and structured financial instruments (2).mp4 [ 58.06MB ]

| | | | | |—— 18-Securitization and structured financial instruments (1).mp4 [ 74.94MB ]

| | | | | |—— 17-Credit derivatives.mp4 [ 78.27MB ]

| | | | | |—— 16-CVA (2).mp4 [ 75.20MB ]

| | | | | |—— 15-CVA (1).mp4 [ 55.62MB ]

| | | | | |—— 14-Netting, close-out and margin (2).mp4 [ 47.07MB ]

| | | | | |—— 13-Netting, close-out and margin (1).mp4 [ 37.51MB ]

| | | | | |—— 12-Counterparty risk and wrong-way risk.mp4 [ 56.52MB ]

| | | | | |—— 11-Capital for credit risk.mp4 [ 64.76MB ]

| | | | | |—— 10-Portfolio Credit VaR.mp4 [ 66.76MB ]

| | | | | |—— 09-Credit Exposure.mp4 [ 62.12MB ]

| | | | | |—— 08-Other Methods to Estimate PD.mp4 [ 56.56MB ]

| | | | | |—— 07-Credit Scoring Model.mp4 [ 38.54MB ]

| | | | | |—— 06-Default Intensity Models.mp4 [ 42.38MB ]

| | | | | |—— 05-Infer Credit Risk from Equity Prices (2).mp4 [ 39.91MB ]

| | | | | |—— 04-Infer Credit Risk from Equity Prices (1).mp4 [ 71.94MB ]

| | | | | |—— 03-Rating assignment methodologies.mp4 [ 66.19MB ]

| | | | | |—— 02-Identification of Credit Risk.mp4 [ 61.62MB ]

| | | | | |—— 01-课程介绍.mp4 [ 31.93MB ]

| | | | |—— 01-市场风险测量与管理 [ 827.55MB ]

| | | | | |—— FRM P2市场风险-复习串讲(David Zhu).pdf [ 23.61MB ]

| | | | | |—— 15-Other related topics (2).mp4 [ 38.89MB ]

| | | | | |—— 14-Other related topics (1).mp4 [ 73.18MB ]

| | | | | |—— 13-The Art of Term Structure Models:Volatility and Distribution.mp4 [ 30.55MB ]

| | | | | |—— 12-The Art of Term Structure Models:Drift.mp4 [ 39.92MB ]

| | | | | |—— 11-The Evolution of Short Rates and the Shape of the Term Structure.mp4 [ 75.42MB ]

| | | | | |—— 10-The Science of Term Structure Models.mp4 [ 115.12MB ]

| | | | | |—— 09-Financial Correlation Modeling Bottom-Up Approaches.mp4 [ 33.37MB ]

| | | | | |—— 08-Empirical Properties of Correlation How Do Correlations Behave in the Real World.mp4 [ 26.99MB ]

| | | | | |—— 07-Correlation Basics Definitions, Applications, and Terminology.mp4 [ 43.74MB ]

| | | | | |—— 06-VaR Mapping.mp4 [ 75.74MB ]

| | | | | |—— 05-Backtesting VaR.mp4 [ 69.07MB ]

| | | | | |—— 04-Parametric Approaches:Extreme Value.mp4 [ 70.08MB ]

| | | | | |—— 03-Non-parametric Approaches.mp4 [ 42.30MB ]

| | | | | |—— 02-An Introduction and Overview.mp4 [ 54.41MB ]

| | | | | |—— 01-课程介绍.mp4 [ 15.15MB ]

| | | |—— 【2】知识精讲答疑直播 [ 1.14GB ]

| | | | |—— 信用风险管理与测量答疑直播讲义.pdf [ 3.89MB ]

| | | | |—— 信用风险管理与测量答疑直播.mp4 [ 212.53MB ]

| | | | |—— 投资管理与风险管理直播答疑讲义.pdf [ 4.96MB ]

| | | | |—— 市场风险管理与测量答疑直播讲义.pdf [ 4.95MB ]

| | | | |—— 流动性与资金风险测量答疑直播讲义.pdf [ 6.68MB ]

| | | | |—— 流动性与资金风险测量答疑直播.mp4 [ 276.24MB ]

| | | | |—— 操作风险与综合风险答疑直播讲义.pdf [ 24.32MB ]

| | | | |—— 操作风险与综合风险答疑直播.mp4 [ 251.39MB ]

| | | | |—— 02-市场风险测量与管理直播答疑.mp4 [ 175.54MB ]

| | | | |—— 01-投资管理与风险管理直播答疑.mp4 [ 208.23MB ]

| | | |—— 【1】知识精讲 [ 17.80GB ]

| | | | |—— 讲义 [ 445.09MB ]

| | | | | |—— FRM P2网课 信用风险管理与测量(2) 2022.pdf [ 62.12MB ]

| | | | | |—— FRM P2网课 信用风险管理与测量(1) 2022.pdf [ 58.77MB ]

| | | | | |—— FRM P2网课 投资管理与风险管理 2022.pdf [ 69.00MB ]

| | | | | |—— FRM P2网课 市场风险管理与测量 2022.pdf [ 59.04MB ]

| | | | | |—— FRM P2网课 流动性与资金风险测量与管理 2022.pdf [ 27.63MB ]

| | | | | |—— FRM P2时事 Holistic Review of the March Market Turmoil.pdf [ 9.45MB ]

| | | | | |—— FRM P2时事 Covid-19 and cyber risk in the financial sector.pdf [ 3.96MB ]

| | | | | |—— FRM P2时事 AI, ML & Big Data.pdf [ 8.68MB ]

| | | | | |—— FRM P2时事 Climate-related risk & Digital money.pdf [ 16.72MB ]

| | | | | |—— 2022 P2网课 操作风险与综合风险(2) 2022.pdf [ 61.20MB ]

| | | | | |—— 2022 P2网课 操作风险与综合风险(1) 2022.pdf [ 68.52MB ]

| | | | |—— 【7】Current Issues in Financial Markets [ 1.08GB ]

| | | | | |—— 08-The rise of digital money.mp4 [ 143.54MB ]

| | | | | |—— 07-Amplifiers and mitigants.mp4 [ 78.11MB ]

| | | | | |—— 06-Climate related risk drives and their transimission channels.mp4 [ 197.82MB ]

| | | | | |—— 05-Holistic review of the march Market Turmoil.mp4 [ 226.70MB ]

| | | | | |—— 04-Covid-19 and cyber risk in the financial sector.mp4 [ 143.46MB ]

| | | | | |—— 03-AI risk & governance.mp4 [ 97.18MB ]

| | | | | |—— 02-AI & ML for risk management.mp4 [ 179.09MB ]

| | | | | |—— 01-Introduction to AI & ML.mp4 [ 38.79MB ]

| | | | |—— 【6】操作风险与综合风险 [ 5.72GB ]

| | | | | |—— 59-Striving for Operational Resilience.mp4 [ 31.13MB ]

| | | | | |—— 58-Principles for operational resilience.mp4 [ 60.88MB ]

| | | | | |—— 57-Operational resilience Impact tolerance for important business services.mp4 [ 86.98MB ]

| | | | | |—— 56-Cyber-resilience Range of Practices(3).mp4 [ 94.15MB ]

| | | | | |—— 55-Cyber-resilience Range of Practices(2).mp4 [ 61.94MB ]

| | | | | |—— 54-Cyber-resilience Range of Practices(1).mp4 [ 103.55MB ]

| | | | | |—— 53-The Cyber-Resilient Organization(2).mp4 [ 79.56MB ]

| | | | | |—— 52-The Cyber-Resilient Organization(1).mp4 [ 132.71MB ]

| | | | | |—— 51-Management of Risks Associated with Money Laundering and Financing of Terrorism.mp4 [ 49.58MB ]

| | | | | |—— 50-Guidance on Managing Outsourcing Risk.mp4 [ 131.82MB ]

| | | | | |—— 49-Supplementary(FRTB).mp4 [ 144.25MB ]

| | | | | |—— 48-Basel Ill Finalizing Post-crisis Reforms(2).mp4 [ 85.88MB ]

| | | | | |—— 47-Basel Ill Finalizing Post-crisis Reforms(1).mp4 [ 118.12MB ]

| | | | | |—— 46-High-level Summary of Basel Ill Reforms(2).mp4 [ 67.23MB ]

| | | | | |—— 45-High-level Summary of Basel Ill Reforms(1).mp4 [ 127.01MB ]

| | | | | |—— 44-Basel III-Liquidity risk & CVA.mp4 [ 142.85MB ]

| | | | | |—— 43-Basel III-Capital requirements (3).mp4 [ 105.83MB ]

| | | | | |—— 42-Basel III-Capital requirements (2).mp4 [ 69.57MB ]

| | | | | |—— 41-Basel III-Capital requirements (1).mp4 [ 86.81MB ]

| | | | | |—— 40-Basel II.5.mp4 [ 91.05MB ]

| | | | | |—— 39-Basel II – Solvency II.mp4 [ 34.98MB ]

| | | | | |—— 38-Basel II – Operational risk.mp4 [ 95.12MB ]

| | | | | |—— 37-Basel II – Three Pillars and Credit Risk(2).mp4 [ 122.61MB ]

| | | | | |—— 36-Basel II – Three Pillars and Credit Risk(1).mp4 [ 76.54MB ]

| | | | | |—— 35-Basel I Amendments.mp4 [ 177.54MB ]

| | | | | |—— 34-Basel I.mp4 [ 142.38MB ]

| | | | | |—— 33-Regulation of the OTC Derivatives Market(2).mp4 [ 84.10MB ]

| | | | | |—— 32-Regulation of the OTC Derivatives Market(1).mp4 [ 80.52MB ]

| | | | | |—— 31-Stress Testing Banks.mp4 [ 120.18MB ]

| | | | | |—— 30-Capital Planning at Large Bank Holding Companies.mp4 [ 87.64MB ]

| | | | | |—— 29-Range of Practices and Issues in Economic Capital Frameworks(2).mp4 [ 99.31MB ]

| | | | | |—— 28-Range of Practices and Issues in Economic Capital Frameworks(1).mp4 [ 143.44MB ]

| | | | | |—— 27-Risk Capital Attribution & Risk-Adjusted Performance(3).mp4 [ 120.44MB ]

| | | | | |—— 26-Risk Capital Attribution & Risk-Adjusted Performance(2).mp4 [ 88.32MB ]

| | | | | |—— 25-Risk Capital Attribution & Risk-Adjusted Performance(1).mp4 [ 89.26MB ]

| | | | | |—— 24-Assessing the Quality of Risk Measures(2).mp4 [ 72.43MB ]

| | | | | |—— 23-Assessing the Quality of Risk Measures(1).mp4 [ 123.34MB ]

| | | | | |—— 22-Validating Rating Models (2).mp4 [ 63.35MB ]

| | | | | |—— 21-Validating Rating Models (1).mp4 [ 70.96MB ]

| | | | | |—— 20-Supervisory Guidance on Model Risk Management(2).mp4 [ 81.91MB ]

| | | | | |—— 19-Supervisory Guidance on Model Risk Management(1).mp4 [ 67.28MB ]

| | | | | |—— 18-Information Risk and Data Quality Management.mp4 [ 140.37MB ]

| | | | | |—— 17-Op risk Data and Governance(3).mp4 [ 46.62MB ]

| | | | | |—— 16-Op risk Data and Governance(2).mp4 [ 149.37MB ]

| | | | | |—— 15-Op risk Data and Governance(1).mp4 [ 161.36MB ]

| | | | | |—— 14-Recommendations.mp4 [ 54.13MB ]

| | | | | |—— 13-Practices to overcome challenges.mp4 [ 87.31MB ]

| | | | | |—— 12-Risk Appetite and It’s Key Findings.mp4 [ 147.22MB ]

| | | | | |—— 11-Enterprise Risk Management Theory and Practice.mp4 [ 115.64MB ]

| | | | | |—— 10-What is ERM(2).mp4 [ 43.67MB ]

| | | | | |—— 09-What is ERM(1).mp4 [ 105.98MB ]

| | | | | |—— 08-Risk Culture.mp4 [ 135.03MB ]

| | | | | |—— 07-Banking Conduct and Culture(2).mp4 [ 72.61MB ]

| | | | | |—— 06-Banking Conduct and Culture(1).mp4 [ 134.12MB ]

| | | | | |—— 05-Principles for the Sound Management of Operational Risk(4).mp4 [ 115.37MB ]

| | | | | |—— 04-Principles for the Sound Management of Operational Risk(3).mp4 [ 128.40MB ]

| | | | | |—— 03-Principles for the Sound Management of Operational Risk(2).mp4 [ 95.35MB ]

| | | | | |—— 02-Principles for the Sound Management of Operational Risk(1).mp4 [ 141.62MB ]

| | | | | |—— 01-Introduction.mp4 [ 73.85MB ]

| | | | |—— 【5】投资管理与风险管理 [ 2.14GB ]

| | | | | |—— 29-finding bernie madoff detecting fraud by investment managers.mp4 [ 94.50MB ]

| | | | | |—— 28-performing due diligence on specific managers and funds.mp4 [ 97.10MB ]

| | | | | |—— 27-risks in hedge funds.mp4 [ 32.62MB ]

| | | | | |—— 26-hedge funds strategies(1).mp4 [ 95.91MB ]

| | | | | |—— 25-hedge funds strategies(1).mp4 [ 63.36MB ]

| | | | | |—— 24-characteristics of hedge funds.mp4 [ 96.00MB ]

| | | | | |—— 23-performance attribution.mp4 [ 82.13MB ]

| | | | | |—— 22-market timing.mp4 [ 58.54MB ]

| | | | | |—— 21-conventional theory(2).mp4 [ 66.07MB ]

| | | | | |—— 20-conventional theory(1).mp4 [ 105.54MB ]

| | | | | |—— 19-RMUs&performance measurement.mp4 [ 34.98MB ]

| | | | | |—— 18-three-legged risk management stool.mp4 [ 26.64MB ]

| | | | | |—— 17-risk budgeting(2).mp4 [ 69.44MB ]

| | | | | |—— 16-risk budgeting(1).mp4 [ 45.76MB ]

| | | | | |—— 15-specific risks in investment management(2).mp4 [ 58.31MB ]

| | | | | |—— 14-specific risks in investment management(1).mp4 [ 69.03MB ]

| | | | | |—— 13-using VaR for risk management.mp4 [ 66.80MB ]

| | | | | |—— 12-portfolio VaR measures.mp4 [ 146.51MB ]

| | | | | |—— 11-portfolio construction techniques.mp4 [ 68.94MB ]

| | | | | |—— 10-inputs for portfolio construction(2).mp4 [ 62.01MB ]

| | | | | |—— 09-inputs for portfolio construction(1).mp4 [ 122.36MB ]

| | | | | |—— 08-benchmarker matters.mp4 [ 133.33MB ]

| | | | | |—— 07-active management.mp4 [ 61.11MB ]

| | | | | |—— 06-dynamic factors.mp4 [ 119.01MB ]

| | | | | |—— 05-macro factors.mp4 [ 90.94MB ]

| | | | | |—— 04-multifactor and EMH.mp4 [ 66.08MB ]

| | | | | |—— 03-factor theory and CAPM (2).mp4 [ 45.24MB ]

| | | | | |—— 02-factor theory and CAPM (1).mp4 [ 81.71MB ]

| | | | | |—— 01-Introduction.mp4 [ 32.27MB ]

| | | | |—— 【4】流动性与资金风险测量与管理 [ 3.07GB ]

| | | | | |—— Session 5 Other Liquidity Issues [ 210.29MB ]

| | | | | | |—— 4-The shortage of US dollar.mp4 [ 29.97MB ]

| | | | | | |—— 3-Covered Interest Rate Parity Lost.mp4 [ 76.61MB ]

| | | | | | |—— 2-The Failure of Dealer Bank.mp4 [ 37.52MB ]

| | | | | | |—— 1-Liquidity Transfer Pricing.mp4 [ 66.19MB ]

| | | | | |—— Session 4 Modelling Liquidity Risk Management [ 607.76MB ]

| | | | | | |—— 4-Risk Management for Changing Interest Rate.mp4 [ 106.01MB ]

| | | | | | |—— 3-Managing Non-deposit Liabilities.mp4 [ 92.46MB ]

| | | | | | |—— 2-Managing and Pricing Deposit Services.mp4 [ 111.51MB ]

| | | | | | |—— 1-Liquidity and Reserves Management Strategies and Polices.mp4 [ 297.78MB ]

| | | | | |—— Session 3 Management of Liquidity Investment [ 901.50MB ]

| | | | | | |—— 12-Illiquid Assets.mp4 [ 311.90MB ]

| | | | | | |—— 11-Repurchase Agreements and Financing(2).mp4 [ 196.38MB ]

| | | | | | |—— 10-Repurchase Agreements and Financing(1).mp4 [ 133.83MB ]

| | | | | | |—— 09-The Investment Function in Financial Services Management.mp4 [ 259.39MB ]

| | | | | |—— Session 2 Framework of Liquidity Risk Management [ 915.86MB ]

| | | | | | |—— 6-Contingency Funding Planning.mp4 [ 140.93MB ]

| | | | | | |—— 5-Early Warning Indicators.mp4 [ 169.82MB ]

| | | | | | |—— 4-Monitoring Liquidity.mp4 [ 271.77MB ]

| | | | | | |—— 3-Intraday Liquidity Risk Management.mp4 [ 152.80MB ]

| | | | | | |—— 2-Liquidity Risk Reporting and Stress Testing.mp4 [ 74.87MB ]

| | | | | | |—— 1-Liquidity Stress Testing.mp4 [ 105.69MB ]

| | | | | |—— Session 1 Introduction of Liquidity Risk Management [ 512.29MB ]

| | | | | | |—— 3-Liquidity and Leverage(2).mp4 [ 145.50MB ]

| | | | | | |—— 2-Liquidity and Leverage(1).mp4 [ 310.33MB ]

| | | | | | |—— 1-Introduction of Liquidity and Treasury Risk Measurement.mp4 [ 56.46MB ]

| | | | |—— 【3】市场风险管理与测量 [ 2.28GB ]

| | | | | |—— Introduction.mp4 [ 49.00MB ]

| | | | | |—— 24-Volatility Smiles.mp4 [ 183.99MB ]

| | | | | |—— 23-Empirical Approaches to Risk Metrics and Hedges.mp4 [ 61.63MB ]

| | | | | |—— 22-Fundamantal Review of Trading Book.mp4 [ 101.60MB ]

| | | | | |—— 21-Messages from the Academic Literature on Risk Measurement for the Trading Book.mp4 [ 74.09MB ]

| | | | | |—— 20-Volatility and Distribution.mp4 [ 102.98MB ]

| | | | | |—— 19-The Art of Term Structure Models Drift (2).mp4 [ 75.64MB ]

| | | | | |—— 18-The Art of Term Structure Models Drift (1).mp4 [ 117.58MB ]

| | | | | |—— 17-The Shape of the Term Structure.mp4 [ 88.95MB ]

| | | | | |—— 16-Issues With Interest Rate Tree Model.mp4 [ 49.68MB ]

| | | | | |—— 15-Binomial Interest Rate Tree Model.mp4 [ 126.29MB ]

| | | | | |—— 14-Financial Correlation Modeling.mp4 [ 76.58MB ]

| | | | | |—— 13-Empirical Properties of Correlation.mp4 [ 57.56MB ]